This Fund’s “Secret” 9% Dividend Will Shock Investors

One of the best things about closed-end fund (CEF) investing is the terrific “bonus” discounts CEFs give us on stocks and other investments.

One of the best things about closed-end fund (CEF) investing is the terrific “bonus” discounts CEFs give us on stocks and other investments.

Here’s what I mean by a bonus discount: CEFs often trade at a level far different—and cheaper—than their net asset value (NAV), or the market price of a fund’s portfolio holdings.

And these discounts aren’t peanuts: you can easily snag CEFs trading at, say, $1.00 per share when their “real” value is $1.10 share—or more.

Right now, there are 3 low-risk, highly diversified funds trading at a near 20% discount to their NAVs (17.6%, on average). All 3 boast dividend yields far higher than the average S&P 500 stock, with one set to pay us up to 9% in cash, in the form of a special dividend.

That’s a deal any value investor should jump at. As Warren Buffett said, the best investors buy “phenomenal businesses at discounted prices.” The only problem, of course, is that those discounts are hard to find! Yet these 3 funds are serving them up on a silver platter.

Before we get into why these 3 funds are so cheap, let’s talk about why this sale is happening in the first place.

A Scared Market

The stock market is weird right now.

Stocks should be skyrocketing, if you just focus on fundamentals; so far in the first quarter, earnings are up 24% from a year ago—a meteoric increase that’s far ahead of the already lofty expectations analysts had put out before earnings season began. But even so, the market is flat on the year.

Mr. Market Takes a Nap

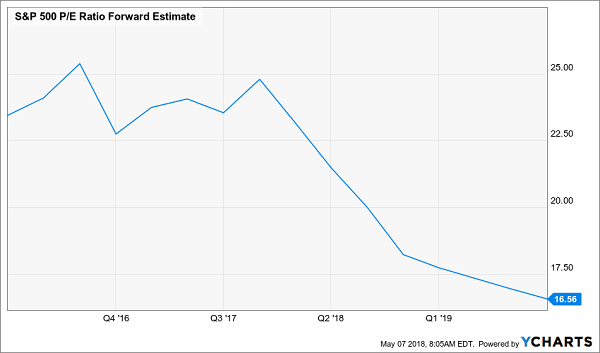

There are many reasons why the S&P 500 isn’t rising, but none have to do with the crucial facts: wages are up, consumer spending is surging, jobless claims are falling and profits are exploding. Since all this strength is hitting the markets and prices are still flatlining, the S&P 500’s forward P/E ratio is plummeting:

A Quick Pivot From Pricey to Cheap

What does this tell us?

Mainly that the market is discounting companies despite their phenomenal results. And when we go a step further, into the CEF world, those discounts get magnified by a huge opportunity CEFs provide: something I call “amplified terror.”

The “Amplified Terror” of CEFs

“Amplified terror” is a term I use to describe the behavior of CEF buyers broadly. When the market is fearful, CEF investors tend to be extra fearful—and any moment of caution in the markets tends to be amplified in CEFs.

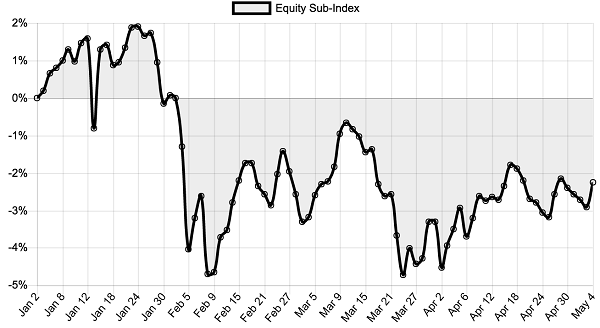

Before I explain why, let me detail exactly what I’m talking about. If we look at the CEF Insider Equity Sub-Index, we see that it has fallen a bit below 2% in 2018:

CEFs Amplify the Fear

Remember that equities are flat year to date, which means CEFs are doing a bit worse.

This is our opportunity.

The reason why is simple: when the market gets afraid, CEF investors get terrified—and the opposite is also true. When the market gets greedy, CEF investors get extremely greedy—which means CEFs can go up a lot faster than stocks in good times. For a patient CEF investor, these downturns are opportunities to get bargains, and the best part is that CEFs offer high yields—so you’re getting paid while you wait for the market to wise up.

And as I mentioned off the top, there are 3 funds offering this opportunity in spades.

A 3-Buy Discount “Swing Play”

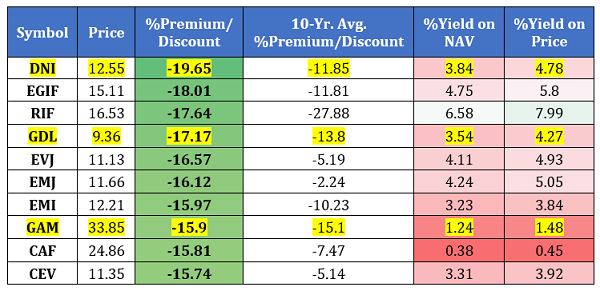

To play against stock market fears and CEF terror, there are 3 funds you should consider now: Dividend and Income Fund (DNI), GDL Fund (GDL) and General American Investors (GAM).

I am spotlighting these 3 funds in particular because of their unusually massive discounts to NAV and their conservative market approach—a best-of-both-worlds opportunity for investors who want maximum return with minimal risk.

Underpriced Equity Funds Are a Rare Bargain

While DNI sports the biggest discount out there now, GDL and GAM make the top-10 list, as well—and each pays a nice dividend. While DNI and GDL pay around 4.5%, on average, GAM pays a special dividend at the end of the year that varies a lot. Last year it was 12%, and I expect it to be above 9% this year for investors who hold through December. That makes for a compelling income stream just by holding these 3 funds.

But that’s not the main reason I like these funds now. With their massive discounts, they are poised for major short-term capital gains.

How do I know? Because this has happened before.

A Snapshot of History

When the market panicked in early 2016, these 3 funds saw their discounts widen due to the amplified terror of CEFs—creating a rare buying opportunity.

These 3 funds then exploded by the end of 2016, creating double-digit gains, thanks to the stock market’s irrational fears and the even more irrational fears of CEF investors. Since 2016 was a year a lot like 2018—starting off weak despite tremendous earnings growth—there’s good reason to expect history to repeat very soon.

How to Earn 12% Annual Returns For Life!

Robust dividend growth separates the winners from the losers.

And I’m not just talking about the stocks.

Low dividend growth goes hand-in-hand with slow and no growth – and even eventual decay. Hitch your wagon to the supposedly “safe” blue chips that most financial pundits shill for, and you’ll quickly be looking for part-time work a few years into your retirement.

If you want to retire fully funded and worry-free, it’ll take more – a lot more. In fact, it’ll take 12% in safe, annual returns.

That sounds impossible, but it’s not. It takes a special kind of portfolio that offers high current yield, and dividend growth, and the potential for double-digit capital gains in some years. But after months of research and weeding out numerous “ticking yield bombs,” I’ve identified a handful of stocks and funds that check all those boxes.

My “12% for Life” portfolio ditches pundit favorites such as Exxon Mobil, Coca-Cola or General Mills – yes, the same General Mills that has lost a quarter of its value this year! – and relies on these kind of picks instead:

- One stock that has juiced its dividend 800%-plus in just four years, and has at least another decade of double-digit growth ahead of it!

- A high-growth, high-yield “double threat” stock that threw off 252% gains the last time it was this cheap.

- A 9%-plus payer that hikes its payout multiple times a year, and is on track to double its payout by 2021!

Let me show you the way to double-digit returns that you can actually depend on. Click here and I’ll GIVE you three special reports that show you how to earn 12% for life. You’ll receive the names, tickers, buy prices and full analysis for seven stocks with wealth-building potential – completely FREE!

Category: Closed-End Funds (CEFs)