Times Are Ripe For Active Management

Summary

Summary

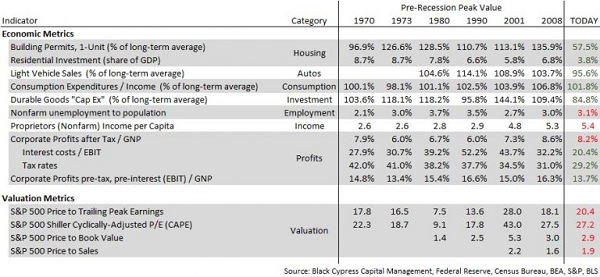

- U.S. stock indexes are trading at or above valuation extremes

- The U.S. economy still has considerable economic slack

- Value-oriented “active” stock selection should thrive

On just about every valuation metric, U.S. stock indexes are trading at or above historical extremes. And yet, while the U.S. equity market is overextended, the U.S. economy is not. This distinction bears considerably on the amount of risk that investors should be willing to take. In our opinion, equating market-based froth with economic excess is ill-considered and the seminal error in the argument to bet against the U.S. and its equity market.

Current valuations do suggest that long-term future U.S. broad market returns will be subpar. But the claim that a bear market is imminent because markets are expensive–an argument made repeatedly by market bears–confuses cause and effect. Expensive valuations may precede bear markets, but market declines are generally caused by larger economic effects. And today, economic data suggests that a recession isn’t in the cards for at least another 18 to 24 months.

Below is a table of two categories of data: economic and stock market valuation. What should be apparent is that considerable economic slack remains in the U.S. economy. Single-family residential building permits are significantly below their long-term, population-adjusted average. Residential investment as a percentage of Gross Domestic Product–housing construction viewed another way–is still at levels lower than at any time before the housing bubble burst. Durable goods orders are scraping along the bottom, and while consumers remain the bedrock of the U.S. economy, consumption as a percentage of income remains unadventurous.

Active Management

While we are over seven years into this economic expansion, the U.S. economy is by no means at risk of overheating. The economic landscape today is one of low inflation and considerable slack in housing, autos, and investment. And, dare we say it, corporate profits aren’t excessive either.

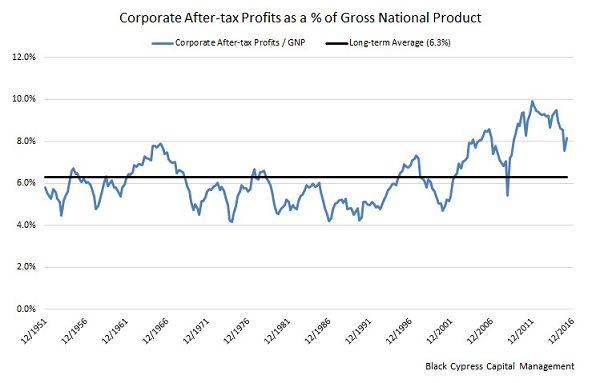

We do not make this last point lightly. Over the last decade the U.S. economy and stock market indexes have posted some of the highest net profit margins in history. Even after a substantial oil & gas profit collapse and a mild industrial recession, net profit margins today are higher than at any point prior to 2005. Below is a graph of Corporate Profits (after-tax) as a percentage of Gross National Product. This can be viewed as the U.S. economy’s net profit margin.

Historically, this margin has bounced around 6.0%. The frequently voiced argument of market bears then goes something like this:

Profit margins are mean reverting, so today’s high levels (8.2%) should fall back to the long-term average of 6.0%. Elevated margins today represent tomorrow’s profit shortfall and bear market catalyst.

This statement, while intelligible and conceivable, is based on incomplete information. That’s because its conclusion–that margins will fall to 6.0% because the net profit margin is higher than normal–ignores the inputs, the drivers that make net profits what they are.

The above graph highlights the net profit margin, that is, corporate operating profits after interest costs and taxes. Net profits are dependent on more than just business profitability. Net profit margins are also driven by economy-wide interest rates and corporate tax law.

After-tax profits are calculated as follows:

Corporate Profits (after tax) = (Operating Profits-Interest Costs) x (1-Tax Rate)

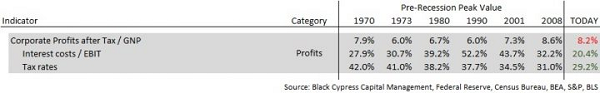

If you look at the table below, you’ll see that while after-tax profit margins are high, both interest costs as a percentage of operating profits and corporate tax rates are the lowest in history.

We do not doubt that interest rates will rise eventually. However, a significant amount of corporate debt is long-term, and therefore corporations have to some extent (and for a time) locked in current low interest rates. When rates do rise, interest costs will do so in a lagged fashion.

As far as corporate tax rates go, there isn’t an impetus to raise U.S. corporate tax rates. In fact, both political parties have discussed lowering them further to make U.S. businesses more competitive globally.

So interest costs aren’t likely to rise materially for some time and corporate tax rates should at the very least remain low. Two of the three variables of corporate profits then look fairly stable at this time.

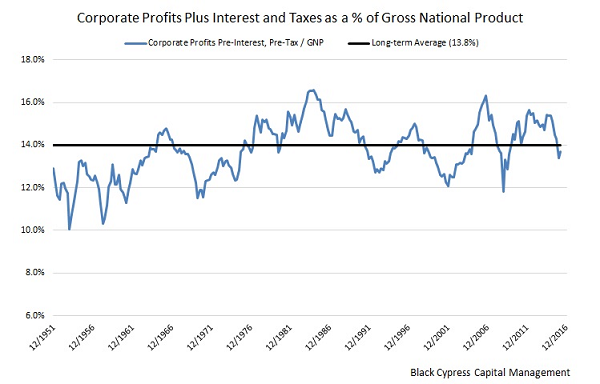

What about operating profits, the measure of true corporate profitability?

Below is the economy-wide operating profit margin, that is, the pre-tax, pre-interest profit margin:

Unlike net profit margins, which can experience an enduring shift if interest or tax rate regimes change materially, operating profit margins are truly mean reverting.

For the last two quarters, the U.S. economy has had operating profit margins below the long-term historical average due primarily to weakness across the drilling and mining industries.

To claim that after-tax profit margins are going to fall back to the 6.0% long-term average because of “unsustainable” corporate profitability misses the mark. Corporate profitability isn’t excessive, as we’ve shown above. It’s average. A 6.0% net profit margin wouldn’t represent excessive corporate profitability being competed away; it would instead mean that interest costs spiked, corporate tax law changed for the worse, or some combination of both. Neither are likely.

Put simply, not even corporate profits are excessive. In fact, operating margins were materially higher at nearly every other market peak than they are today:

Why should we care?

Logical investment decisions depend on knowledge, as much as one can reasonably get, and not on opinions or data that merely confirms our biases.

If we had been investing capital consistent with the bear argument that net profit margins were set to fall to 6.0%, the implication being that profits would decline 25%, our investment stance would have been highly defensive–and wrong.

We’re seven years into this economic expansion, the second longest in history. But expansions don’t die of old age, they typically die of economic excess and aggressive monetary tightening. As we’ve shown above, the U.S. economy still hasn’t reached average levels of production. That means we probably have at least a couple of years of growth to go and perhaps longer. Thus the economic landscape is positive for corporate America.

Of course, stock market indexes already reflect much of that. They are trading for valuation multiples higher than at every other time in history except the technology bubble. Companies are operating in an ideal economic environment, one of low inflation, slack to grow into, an accommodating Fed and, increasingly, a less restrictive Federal government. But that’s priced into stocks. The opportunity set and situation for investors isn’t as bright as it is for the companies in which they invest.

We can infer a few useful things from that.

First, recession risk remains fairly low and thus a sustained market decline is unlikely. Second, index and overly-diversified investors are likely to earn lower-than-average returns, barring a full-blown stock market bubble. And third, this environment, expensive stock markets within an improving economy, is ripe for active management.

Broad markets appear priced for muted returns, but some individual stocks offer substantial value that can be unlocked as the economic expansion continues. Said another way, this is a great time to be an active manager or to invest in one.

Note: The author of this article is Alan Hartley. He is a contributor to ValueWalk.com.

Category: What's Going On?