Top 3 Stocks To Own In The Hot Robotics Sector

Set yourself up for years of profit by adding at least one of these high-tech robotics stocks to your portfolio. Plus, Tony Daltorio shares how robots will enhance every aspect of our world and how these three stocks will help you cash in on this technological mega-trend.

Set yourself up for years of profit by adding at least one of these high-tech robotics stocks to your portfolio. Plus, Tony Daltorio shares how robots will enhance every aspect of our world and how these three stocks will help you cash in on this technological mega-trend.

At one time, the only robots you and I would come in contact with was in movies like Star Wars. But no more… the age of robots is upon us. They are in our homes (think Alexa), in our workplace, and all around us the form of drones, driverless cars, etc.

This has turned the entire robotics-related sector into a big business and a very rapidly growing one. According to the technology intelligence service, International Data Corporation (IDC), worldwide spending on robotics and related services in 2016 was $91.5 billion. IDC forecasts that figure to more than double to $188 billion in 2020.

The forecast makes sense with robots becoming useful in more and more sectors. The biggest spenders on robotics in 2016 were manufacturing, mining, consumer-related industries, and healthcare. IDC says the fastest uptake in the period to 2020 will come from the consumer, healthcare and retail industries.

Meet Your Cobot Co-worker

The advance of the robots is being made possible by progress in technologies like big data, deep learning (artificial intelligence), graphics processing units and machine vision.

The reality is that many of us in the not too distant future will be working alongside a robot, whether it’s a real metallic one or a virtual one (AI bots). The term given to these type of robots is collaborative robots or cobots. I find them the most intriguing from an investment viewpoint because they are a disruptive technology.

The British market research firm, TechNavio, predicts cobots will become the fastest growing subsector of robotics. It sees the cobot market growing at a compound annual growth rate of 50.88% to 2019. Cobots, from a mere $95 million sector in 2014, will become a sector worth more than a billion dollars by the end of the decade. In other words, it is moving from a niche market to a foundational technology of the future, growing at an exponential rate.

The good news for us humans is that cobots are designed to work alongside people, not replace them. In fact, researchers at MIT found that robot-human teams were about 85% more than productive than either humans or robots alone!

The robot technology manager at the Danish Technology Institute, Søren Peter Johansen, is in agreement with the MIT study. He says that automating the simplest 80% of a production process is significantly cheaper than a fully automated solution. The remaining 20% of the work will be done by human co-workers.

If you take a moment and think about it, that makes sense. We humans can adapt to a situation much more rapidly than a robot. And robots to date aren’t very dexterous. There was a study about a year ago that showed it took a robot 20 minutes to fold a towel.

Cobot Investment

Unfortunately, there is no pure play cobots firm. But Universal Robotics is intriguing. It is a Danish robotics firm that was purchased by Teradyne (NYSE: TER) in 2015 for $285 million.

Unfortunately, there is no pure play cobots firm. But Universal Robotics is intriguing. It is a Danish robotics firm that was purchased by Teradyne (NYSE: TER) in 2015 for $285 million.

It was the first mover in the cobot space and is the leading collaborative robots business at the moment. The company itself believes its technology is two or three years ahead of its nearest competition. But I suspect its lead has narrowed thanks to recent strides made by competitors like ABB (NYSE: ABB).

Its cobots are used in industries ranging from automotive to electronics to pharmaceuticals to metals. Companies using its cobot technology include Lear (NYSE: LEA), Johnson & Johnson (NYSE: JNJ) and BMW (OTC: BMWYY).

The company experienced a growth rate of 62% from 2015 to 2016. And Universal Robotics’ President, Jürgen von Hollen, expects revenue growth of 50% or greater in 2017.

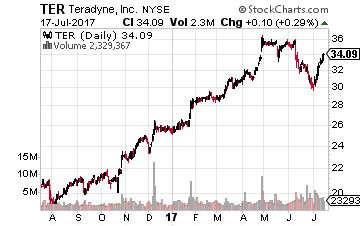

The parent company, Teradyne, though is mainly a supplier of automation equipment for testing (largely semiconductors) and industrial applications. That’s another great business at the moment. The stock is up 33.75% year-to-date and 63.5% over the past year.

Teradyne’s robotics revenues overall are small when compared to its main business. For example, in the first quarter of 2017, overall sales were $457 million. Of that total, $356 million came from semiconductor testing. Only $36 million came from the company’s entire industrial automation division.

Nevertheless, Teradyne is a good investment – a semiconductor-related company with a robotics growth kicker.

Two Robotics ETFs

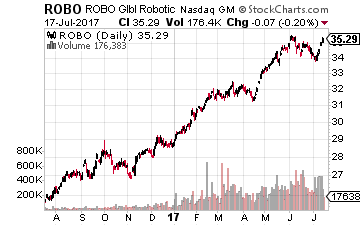

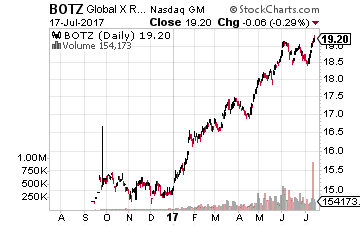

If you want more of a pure play on robotics, there are two ETFs that fit the bill. They are the Robo Global Robotics & Automation ETF (Nasdaq: ROBO) and the Global X Robotics & Artificial Intelligence ETF (Nasdaq: BOTZ).

If you want more of a pure play on robotics, there are two ETFs that fit the bill. They are the Robo Global Robotics & Automation ETF (Nasdaq: ROBO) and the Global X Robotics & Artificial Intelligence ETF (Nasdaq: BOTZ).

Both are good choices with all of the leading companies in the broad robotics field globally. But there are differences in their respective portfolios.

One main difference between the two ETFs is that BOTZ is more concentrated. Its top position is Nvidia (Nasdaq: NVDA), making up 7.7% of the portfolio. The top position at ROBO, Aerovironment (Nasdaq: AVAV), makes up only 2.18% of the portfolio.

Another important difference is that BOTZ has more overseas exposure, with North America accounting for only roughly 25% of the portfolio. In contrast, ROBO has about 44% in North American companies. In both cases, the low North American exposure is due to the fact that many of the top robotics-related, publicly-traded firms come from Japan.

Another important difference is that BOTZ has more overseas exposure, with North America accounting for only roughly 25% of the portfolio. In contrast, ROBO has about 44% in North American companies. In both cases, the low North American exposure is due to the fact that many of the top robotics-related, publicly-traded firms come from Japan.

I believe robotics is and will continue to be one of the best exponential growth industries you can invest in.

How to Collect $4,238 in Extra Monthly Income

I’ve just released updated details on a new system for collecting $4,238 in extra monthly income… for the rest of your life. It’s called the Monthly Dividend Paycheck Calendar because if you follow it you’ll collect dividend paychecks every month. And in certain months you can collect up to 6, 7, even 12 paychecks. You need to be enrolled in the next couple days in order to make sure you’re on the list of the first payouts and don’t miss your first $4,238 in extra monthly income. Click here to start.

Category: ETFs