Why Hedge Funds Love ETFs

Following hedge fund managers’ strategies can be lucrative for your investment portfolio. One of the latest trends being set by these industry players that you may consider following is their investments in ETFs.

Following hedge fund managers’ strategies can be lucrative for your investment portfolio. One of the latest trends being set by these industry players that you may consider following is their investments in ETFs.

Hedge Fund Managers Embrace ETFs Setting the Stage for Investors to Follow

If you believe in following the investing strategies of top hedge fund managers, there is something almost all of them are increasingly doing that you should take note of and make sure you are doing, too.

They are stocking their funds with exchange traded funds, or ETFs. The main reason is simple. The low fees that are inherently a part of ETFs. A recent study by a Source found that nine out of 10 of hedge fund professionals expect to see an increase in their ETF holdings by the end of the year.

Here, we’ll go over that study, and give you some examples of how ETFs are becoming the “best friends” of hedge fund managers.

Some background

We told you about the mechanics of ETFs in June, explaining that ETFs are baskets of securities that trade like stocks. They track a major index, such as the Dow Jones, Nasdaq-100 and S&P 500. ETFs can be based on different sectors, categories, and assets classes. Asset classes are the most common, and include stocks and bonds. When you buy ETF shares, you are buying shares of a portfolio.

An estimated 1,600 ETFs existed at the end of 2016.

And the survey says

The study was conducted by Source, one of the largest ETF providers in Europe. While Source is based in Europe, its findings reflect strategies used by hedge fund managers globally.

In completing its study, Source asked hedge fund professionals to weigh in on the growth of ETFs among managers in their field.

The study found that roughly 92% expect to see an increase of at least $55 billion by the end of the year. This marks an increase of more than $10 billion over 2016.

Almost 20% of respondents believe that the increase could be even more, saying they saw $70 billion as feasible. Even more impressive is the optimism that by 2021, the volume of ETFs could reach $100 billion.

What’s driving the hedge fund interest

The drivers cited behind the rise varied. After the low costs, other attractive features of ETFs were:

- liquidity

- easy access to sector exposure

- ability to trade on exchanges

- flexibility over long and short positions

More than half of those surveyed said they believe more hedge funds – especially smaller ones – will use ETFs to reduce their costs and fees. As a result, they can be more attractive to compete for clients.

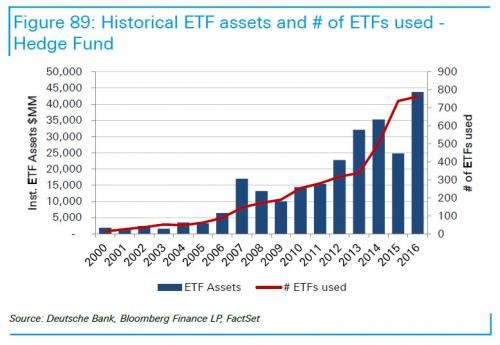

A report by Deutsche Bank in 2016 made similar findings. For example, it found hedge fund usage of ETFs has surged, indicating hedge funds are finding value in using ETFs.

It’s also been observed that hedge fund managers are increasingly including ETFs to suit the needs of clients who are moving toward indexed strategies and away from fundamental investing.

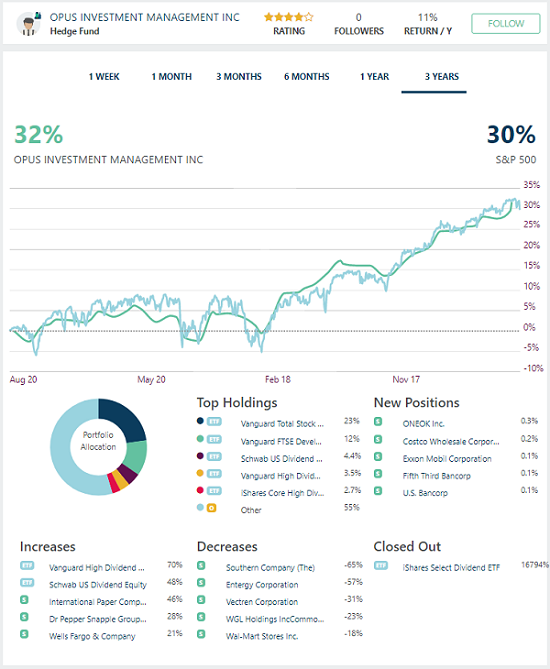

Opus Investment Management is s good example of a fund which invests in ETFs

Something to consider

Hedge fund managers may be enthralled with ETFs, but their positions may not jive with the strategies of long term investors.

Bloomberg senior ETF analyst Eric Balchunas told ETF.com that hedge funds have more short-term positions than long-term positions in ETFs.

“They have $104 billion in short positions compared to $30 billion in long positions,” Balchunas said.

No matter, the ETFs in which they have long positions are worth considering. One of them is the Vanguard FTSE Emerging Markets fund. It tracks a market-cap-weighted index of emerging-market stocks.

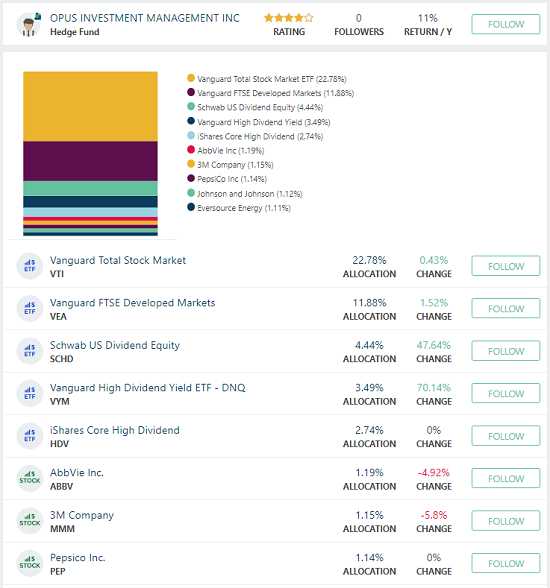

Opus Investment Management has 22,78% of their portfolio value in Vanguard Total Stock Market, see which other hedge funds who owns Vanguard Total Stock Market, see which other hedge funds who owns Vanguard Total Stock Market

In conclusion

ETFs continue to be strong investment choices because of their low costs and liquidity advantages. The fact that they are increasingly being included in the investment strategies of hedge fund managers bodes well for them.

Chris Mellor, Executive Director of Equity Product Management at Source, said:

“Hedge fund managers are sophisticated investors and it is clear they are increasingly seeing the benefits that ETFs provide them, such as a cost-effective means to execute their strategies. We are seeing strong demand from hedge funds and expect this to escalate as ETFs play a progressively core role in investment strategies.”

Note: This article originally appeared at KINFO.

Category: ETFs