What Is An ETF?

Exchange traded funds have been around for a few decades now. But many investors still find themselves asking… What is an ETF?

Exchange traded funds have been around for a few decades now. But many investors still find themselves asking… What is an ETF?

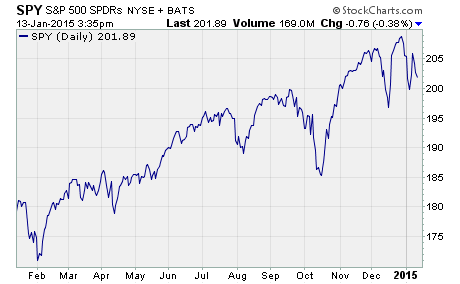

In short, ETFs are funds that are publicly traded just like a stock.

When you buy shares of an ETF, you are actually buying shares of the basket of assets that the ETF holds.

How do you know what assets an ETF holds?

One of the key components of an ETF is the index. The index is the underlying foundation that ETFs are built on.

The index can be a stock index like the S&P 500… or a bond index like US Treasury Bonds… a value of a commodity like gold… or even real estate.

These days there are indexes that track just about every type of asset you can imagine.

A unique quality that separates ETFs from other types of funds is ETFs seek to replicate the performance of an index. An ETF doesn’t try to beat the index… it tries to match it.

As a result, most ETFs are passively managed. That means there isn’t a portfolio manager selecting assets they think will outperform the market. They simply hold the same assets as the index.

As the ETF industry has grown, so have the number of indexes that are available for an ETF to track. Today there’s an entire sub-industry in the financial world that creates new indexes for ETFs to track.

That’s leads me to the next thing you need to know about ETFs…

Where do ETFs come from?

In the US, ETFs are created by large financial institutions. These ETF providers must get permission from the Securities and Exchange Commission to launch an ETF.

Most ETF providers offer many different ETFs that track different indexes. These are called ETF families. You’ll quickly start to recognize ETF families like iShares, SPDR, PowerShares, Vanguard, Market Vectors, Global X, and many others.

These ETF providers are in direct competition for your investment dollars. They make money by charging a small management fee. So they want as much money as possible in their ETFs.

In fact, most ETF providers offer similar products. They differentiate themselves based on costs and the index that the ETF tracks. So, the competition among ETF providers has given rise to a lot of new indexes that track similar investment in different ways.

Now that you know what an ETF holds and where they come from – I’m sure you’re wondering…

How do you buy an ETF?

You can’t just call up an ETF provider like iShares and buy one of their ETFs. In order to buy an ETF, you must have a brokerage account.

These are companies like Charles Schwab, Fidelity, TD Ameritrade… and there are lots more to choose from.

Almost all brokers offer ETF trading these days… some even have their own line of ETFs or select groups of ETFs that you can trade commission free.

Needless to say, commission free ETF trading can save you a lot of money over the long run. So, make sure to inquire about commission free ETF trading before you open a brokerage account.

I hope that helps you understand what an ETF is.

Good Investing,

Corey Williams

Note: Corey Williams writes and edits ETFTradingResearch.com. Sign up for our free ETF reports and free e-letter at http://etftradingresearch.com/free-sign-up. We’re devoted to helping you make more money from ETFs.

Category: ETFs