3 Strategies For Shorting The Bursting Biotech Bubble

Follow any of these three easy to understand, step-by-step strategies that detail exactly how any investor can profit from the collapse in biotech.

Follow any of these three easy to understand, step-by-step strategies that detail exactly how any investor can profit from the collapse in biotech.

The biotech sector is a bursting bubble. Unfortunately, making money from a bursting bubble requires investors to go short on a stock. Shorting a stock exposes an investor to a theoretically infinite amount of risk, which is why so many investors are opposed to shorting.

But, options strategies allow investors to safely short markets and even entire sectors. If you’re not currently using options to short the market, you are either:

- Not shorting the market, in which case you are missing out on the immense bear market gains.

- Outright shorting, and, therefore, exposing yourself to unlimited risk.

With options, we can safely short the market, using the iShares NASDAQ Biotechnology ETF (NASDAQ: IBB). This ETF is currently in the process of bursting, after reaching its top in July 2015. The rounded top is a classic signal of a bursting bubble:

Biotech stocks are down 40% from their July high, but this does not mean the bubble is done bursting. IBB just recently fell under its last remaining support at $257. From here, there is no support below, implying the bottom is far from in.

As an increasing amount of negative economic news flows into the hands of investors, they will liquidate their biotech positions. This is already happening, as we see investors flock from biotech and into other forms of tech, such as wireless, marketing, and semiconductors. Just as in January 2016, IBB broke through its previous support level at $319, falling all the way to where it is now, IBB could easily repeat the process with this $257 support level. If so, we could see another 20% drop in the IBB.

But the main advantage using options on IBB lies in IBB’s price. Options give us a significant amount of leverage to where we can easily double or triple our investment through a small downward movement in IBB. Let’s look at our “options options.”

Bear Credit Spread

This is the “professional” choice, as most professional options traders make their money through time decay. That is, options have a peculiar quality in that they lose value every day. Thus, one can sell an option and buy it back later for cheaper, even if IBB does not move.

An example of this strategy follows:

- Sell 260 April calls

- Buy 265 April calls

This strategy brings you $135 in immediate income. And,4 as long as IBB is under $260 by April 15, you get to keep all that income. Note that $260 is above the $257 resistance level, implying a high level of safety.

In addition, because we bought the April 265 calls, we limit our potential losses. Say that IBB miraculously jumps back up to $265 or above – we only lose $500. Did you catch that? Even if IBB goes back to $400, our max loss is still only $500.

The main benefit here is that we don’t even need IBB to fall. We just need it to stay below $260 for less than a month and we take home all the $135. And even if IBB does somehow pop above the resistance level, we will never be risking more than $500.

Related: Gain FREE access to a new system for booking safe 16% returns every year.

Long Put

For some investors, the $500 risk for a $135 reward is not attractive. For those investors, I say go with a long put. A long put will yield you nearly $100 for each $1 movement downward in IBB.

An example of a long put follows:

- Buy 225 June puts

This option is sufficiently out of the money, meaning it can be bought for incredibly cheap – $590 at the moment. But you will gain the ability to mimic holding 22 shares of IBB short. And as IBB falls, this option “gives you” more free short shares, eventually capping at 100 short shares.

That is, eventually, you will be holding 100 shares of IBB short, once IBB falls enough. And for every $1 move downward in IBB, you gain $100 on your $590 investment. With IBB moving $5 per day, you can quickly recoup your investment and earn 100% or more ROI.

The only significant downside of this low-risk strategy is time decay. At present, this option loses $7 of value per day. Mathematically, you need IBB to fall an average of $0.30 per day to break even; but, we have already seen that IBB is certainly more than capable of that.

Bear Debit Spread

Still, what if you believe that the $7 per day “holding fee” is unacceptable? You can use a bear debit spread instead. In this strategy you sell another put in addition to the put you bought.

An example follows:

- Buy Sept 255 Puts

- Sell Sept 240 Puts

Now your theta value (time decay) is zero. So, you are losing nothing to hold this position open. However, your profits are now capped at $1,500.

This strategy costs $650. So, you could easily nearly triple your investment. That maximum profit is realized if IBB falls below $240 before September 16.

This strategy would be used if you don’t think IBB is going to fall fast and hard.

Which One to Choose?

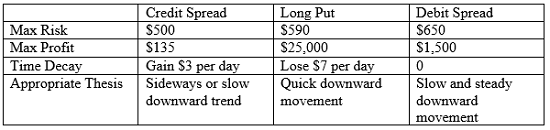

The three options strategies above all have limited risk. However, the one you choose should match your thesis on how fast IBB will fall. The table below should help you make your decision.

None of these strategies are 100% guaranteed, but with the state of the biotech sector at the moment (lower probability of clinical trials being successful, weaker earnings reports, poor investor sentiment, etc.), all of the above strategies are pretty safe bets. Most investors stay away from IBB because of its high prices. But as I’ve shown with these strategies, you only need risk a couple hundred dollars to play this bursting bubble.

Conclusion

These strategies can be used on other stocks and ETFs as well. Think of the last stock that you knew was going to fall. Chipping in a few hundred bucks to take advantage of a decline allows you to play the short of the market with limited risk.

I recommend you try one of these strategies on at least IBB, if not another overpriced stock. Some other stock suggestions to run these on are:

- Alexion Pharmaceuticals (NASDAQ: ALXN)

- Biogen (NASDAQ: BIIB)

- Cardinal Health (NYSE: CAH)

New Report Reveals How to Safely Earn 16% Returns in 2016

Why settle for puny 1% yields on CDs when you can double your money in 4.5 years with a certain class of safe, dividend-paying stocks?

All you have to do is plug your portfolio into the Accelerating Dividends System. This breakthrough investment tool works by identifying little-known stocks that consistently increase their payouts year after year…no matter what the market does.

Right now you can get access to this system for free.

Note: Damon Verial is the author of this article. Coupling statistics with fundamental analysis, he has the goal of revealing to you the hidden patterns within stocks so that you may do what you wish with that information.

Category: What's Going On?