3 Things You Need To Know In Our June Stock Market Update

June has started off in the same way as they’ve been for the past several months… no surprise there.

June has started off in the same way as they’ve been for the past several months… no surprise there.

There’s a lack of conviction from buyers and sellers alike. The latest AAII Investor Sentiment Survey is a perfect example.

According to AAII, 27% of investors are bullish on stocks over the next six months, 25% are bearish on stocks over the next six months, and 48% of investors are neutral.

To give you some context, the long-term average for the study is 39% bullish, 30% bearish, and 31% neutral. As you can see, there are a lot more people than normal that don’t have a strong feeling about the market.

Fundamental June Stock Market Update

The final reading on Q1 GDP growth shows the US economy shrank in the first three months of the year. It’s the second year in row that US GDP has slumped in Q1.

GDP ended up shrinking 0.7% in Q1 after the initial reports showed it had expanded by 0.2%. Needless to say, that’s a disappointing mark for the US economy. And likely puts the 3% GDP growth many expected this year out of reach.

Amazingly, Wall Street was prepared for even worse news… they were expecting GDP growth to a negative 1%… so the 0.7% slump was mostly shrugged off.

Keep in mind, the future is more important than the past and GDP tells what has already happened.

Current data on jobs and consumer sentiment are indicative of an uptick in economic growth in the 2nd quarter. In short, companies are hiring new workers and consumers have an optimistic outlook on their future.

The positive momentum for the economy should spill over into bullish momentum for stocks.

Technical June Stock Market Update

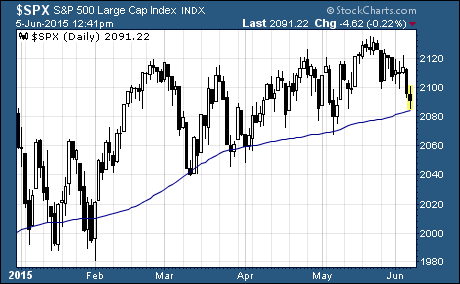

Taking a look at this chart of the S&P 500 shows a good short term buying opportunity.

The 100-day moving average has been a strong floor of support for the S&P 500 over the last three months. As you can see, the S&P 500 has bounced at this support level.

In fact, the large cap index has gone onto set new highs within a few weeks the last two times it has tested support of the 100-day moving average.

Simply put, this is a good entry point for short term traders to get long the S&P 500.

Key Takeaway From June Stock Market Update

Investors continue to be hyper-focused on the timing of the first Fed rate hike. But a transition to a healthier view of the global economy is needed.

As far as I’m concerned, the ‘bad news is good news because interest rates will be next to zero forever mentality’ has been played out.

I think the next big leg up for stocks will come when we see stabilizing of inflation rates around the world, solid economic growth, and slightly higher interest rates.

The rest of the world is ready for this too. But the economic data simply doesn’t support the conclusion that we’ve reached this critical juncture.

Until then, we’ll likely see more of the same performance and lack of conviction.

Think of it this way…

We know that low interest rates make stocks more attractive than bonds. This has helped propel stocks higher over the last several years.

So, until interest rates rise off these extreme levels, then there’s no reason for investors to sell stocks because there’s no better place for them to put their money.

But at the same time, the lack of growth and general lack of momentum for the economy doesn’t give investors reason to leverage up or pump money into aggressive strategies that will benefit from faster economic growth.

In other words, stocks are the best place to be right now because the current monetary policies are supportive of stock prices.

As we transition to a healthier period with rising interest rates, faster economic growth, and steady inflation, stocks will again be the best place to be but for different reasons.

There’s sure to be a dip or pullback as we transition from one period to the next, but this will also be a great buying opportunity.

In short, there’s a lot of noise out there. But the path ahead is still bullish for stocks.

Good Investing,

Corey Williams

Note: Corey Williams writes and edits ETFTradingResearch.com. Sign up for our free ETF reports and free e-letter at http://www.etftradingresearch.com/free-sign-up. We’re devoted to helping you make more money from ETFs.

Category: Market Analysis