May ETF Fund Flows Send ETF Assets Past $2.15 Trillion

I knew this day was coming… ETFs are more popular than mutual funds.

I knew this day was coming… ETFs are more popular than mutual funds.

Don’t get me wrong, total assets in mutual funds still dwarf those of ETFs. But financial advisors are recommending ETFs more often than mutual funds to their clients today.

According to the 2015 Trends in Investing Survey by the Journal of Financial Planning and the FPA Research and Practice Institute, ETFs have assumed the role of preferred investment vehicle among advisers, with 81% of financial advisers surveyed are currently using or recommending ETFs with their clients.

The growth among advisors recommending or using ETFs has been off the charts.

Get this, in 2006, 40% of advisors used or recommended ETFs. By 2008, 44% were recommending ETFs. In 2014, it shot up to 79% and this year it hit 81%.

The popularity of ETFs overtook mutual funds that were used or recommended by 78% of advisors in 2015. Needless to say, fund flows into and out of ETFs are becoming more and more important to the overall market.

ETF fund flows are a valuable indicator of what traders are thinking. It takes a lot of buying or selling to drive millions or even billions of dollars into or out of individual ETFs.

Fund flows are something traders use to find trends and gauge investor sentiment. And it can help you pinpoint which ETFs could be next to make a big move higher or lower.

Let’s take a look at the May ETF fund flows and other sentiment indicators for clues to the market’s next move.

The Emotion Driving May ETF Fund Flows…

We haven’t seen many indications of greed in the market the last few months.

The markets have lost bullish momentum, volatility is picking up, and investors simply aren’t taking many risks in the stock or bond markets.

Needless to say, it appears that fear is taking control of the market.

The ETFs With The Largest Inflows In May…

Amazingly, ETFs that hold non-US stocks enjoyed the largest net inflows for the fourth month in a row.

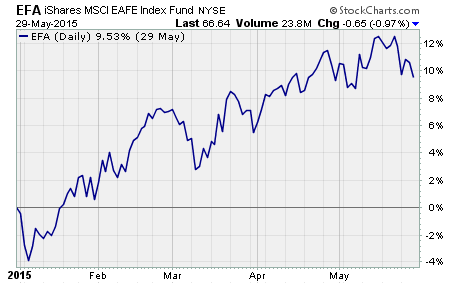

iShares MSCI EAFE ETF $EFA led all ETFs with $1.5 billion in net inflows in May.

EFA holds stocks from developed markets outside of the US and Canada. These are primarily European, Australasian, and Far Eastern markets.

One thing’s for sure, investors are continuing to pump money into ETFs that hold anything but US stocks.

The ETFs With The Largest Outflows In May…

Outflows hit a wide swatch of ETFs.

The SPDR Gold ETF $GLD lost $902 million while the popular energy ETFs Energy Select SPDR $SLE lost $648 million and iShares US Energy $IYE lost $539 million in assets.

But US Treasury ETFs were far and away the hardest hit with outflows. Two of the top 3 net outflows were ETFs that hold US Treasuries.

The biggest loser was iShares Short Treasury Bond $SHV that lost a whopping $1.6 billion. And iShares 20+ Year Treasury Bond $TLT lost $1.1 billion.

These outflows seem to indicate that the investors that were hoping for a quick rebound in energy stocks and rising interest rates are pulling out of these investments.

Here’s the bottom line…

Investors are pulling out of their trades that were made based on their expectation for higher interest rates and a rebound in energy stocks. They’re moving this money into ETFs that focus on foreign stocks.

And I can’t blame them. I see more upside in non-US stocks than I do in US stocks. But that doesn’t mean the bull market for US stocks is over… far from it.

The cheap money, low levels of inflation, and sluggish economic growth have been a great concoction that has propelled US stocks higher over the last five years. And the way I see it, that’s not changing any time soon.

Good Investing,

Corey Williams

Note: Corey Williams writes and edits ETFTradingResearch.com. Sign up for our free ETF reports and free e-letter at http://www.etftradingresearch.com/free-sign-up. We’re devoted to helping you make more money from ETFs.

Category: Market Analysis