5 Best ETFs For February

Today, we’re recognizing the 5 Best ETFs for February 2016.

Today, we’re recognizing the 5 Best ETFs for February 2016.

These stock ETFs have climbed the mountain to deliver investors with superior returns. To be fair, we’re excluding any leveraged ETFs… ETFs that use these performance enhancing drugs aren’t fit for most investors.

5 Best ETFs For February Based On 1-Month Performance

- iShares MSCI Global Gold Miners $RING – 20.0%

- PowerShares Global Gold and Precious Metals $PSAU – 14.7%

- Market Vectors Gold Miners $GDX – 14.6%

- Sprott Gold Miners $SGDM – 13.2%

- Sprott Junior Gold Miners $SGDJ – 12.1%

Important Details About The 5 Best ETFs For February

Let’s look at the holdings, amount of money investors have put in the ETF (also called assets under management or AUM), expense ratio, and dividend yield.

iShares MSCI Global Gold Miners $RING holds 30 stocks, has $64.6 million in assets under management, and an expense ratio of 0.39%.

PowerShares Global Gold and Precious Metals $PSAU holds 47 stocks, has $17.5 million in assets under management, and an expense ratio of 0.75%.

Market Vectors Gold Miners $GDX holds 37 stocks, has $798.9 million in assets under management, and an expense ratio of 0.53%.

Sprott Gold Miners $SGDM holds 25 stocks, has $114.4 million in assets under management, and an expense ratio of 0.57%.

Sprott Junior Gold Miners $SGDJ holds 35 stocks, has $26.8 million in assets under management, and an expense ratio of 0.57%.

Can You Make Money With The 5 Best ETFs For February?

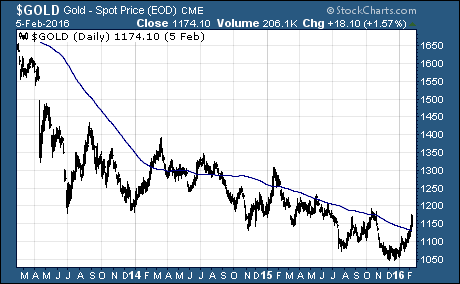

It’s been a good month to be a gold miner. But don’t forget that gold and gold miners are in a multi-year bear market.

We’ve seen sharp counter-trend rallies like this in the past. But they’ve all fallen flat on their face. And gold and gold miners stock have gone on to set lower lows.

Good Investing,

Corey Williams

Note: Corey Williams writes and edits ETFTradingResearch.com. Sign up for our free ETF reports and free e-letter at http://www.etftradingresearch.com/free-sign-up. We’re devoted to helping you make more money from ETFs.

Category: ETFs