5 Best ETFs For January

2016 is starting off with a historically bad first week. The Dow lost 1,079 points. That’s a 6% drop for the blue chip index.

2016 is starting off with a historically bad first week. The Dow lost 1,079 points. That’s a 6% drop for the blue chip index.

A combination of falling oil prices and turmoil in Chinese financial markets has sent investors to the sidelines. And I don’t blame them…

Oil prices are at their lowest levels in years. Every time oil takes a nosedive, the price of energy stocks follows.

And trading of Chinese stocks was halted twice last week when the market triggered the circuit breakers that kick in during periods of extreme volatility.

Traders can turn to inverse ETFs to profit from these periods of market selloffs. Inverse ETFs move in the opposite direction of the underlying index.

Let’s take a look at which inverse ETFs have the best 1-month performance…. We’ll stick to the ones that don’t use leverage.

Here they are…

5 Best Inverse ETFs For January Based On 1-Month Performance

- 22.9% – DB Commodity Short ETN $DDP

- 20.4% – AccuShares Spot CBOE VIX Down Shares $VXDN

- 16.8% – United States Short Oil $DNO

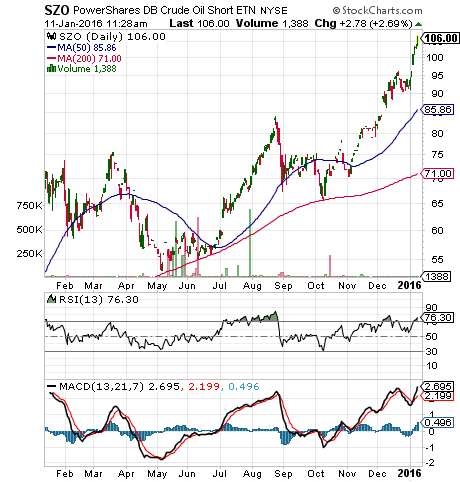

- 14.2% – DB Crude Oil Short $SZO

- 11.8% – ProShares Short FTSE China 50 $YXI

Important Details About The 5 Best Inverse ETFs For January

Let’s look at the holdings, amount of money investors have put in the ETF (also called assets under management or AUM), expense ratio, and dividend yield.

DB Commodity Short ETN $DDP tracks an index of futures contracts on wheat, corn, crude oil, heating oil, gold, and aluminum. This ETN has only accumulated $2.0 million. It has an expense ratio of 0.75%. It doesn’t pay a dividend.

AccuShares Spot CBOE VIX Down Shares $VXDN tracks the inverse of movements in the CBOE Volatility Index. This index measures the expected price volatility of the S&P 500 based on stock option activity. This Exchange Traded Product is very complex. And it comes with a hefty price tag… the expense ratio is 0.95%. It has accumulated $1.2 million in assets.

United State Short Oil $DNO tracks an index of futures contracts for light sweet crude oil delivered to Cushing, Oklahoma. It’s designed to move in the opposite direction of WTIC oil prices every day. It has only accumulated $27 million in assets even though it has been around since 2009. The expense ratio is a whopping 1.14%. It doesn’t pay a dividend.

DB Crude Oil Short ETN $SZO tracks an index of oil futures that are expected to be least impacted by contango. It has $20.7 million in AUM. The expense ratio is 0.75%. It doesn’t pay a dividend.

ProShares Short FTSE China 50 $YXI tracks an index of 50 Chinese stocks listed on the Hong Kong Stock Exchange. It’s designed to provide inverse exposure to these stocks on a daily basis. It has $11.24 million in AUM. The expense ratio is 0.95%. It doesn’t pay a dividend.

Can You Make Money With The 5 Best Inverse ETFs For January?

A common thread among these ETFs is the lack of assets that have accumulated in these ETFs. And for good reason… these ETFs are not designed for buy and hold investors. These ETFs are trading vehicles for short term traders.

If you’re like many of the investors I’ve heard from, you probably have already moved a large portion of your portfolio into cash.

These ETFs give you a way to put some of that money to work on a short term basis. Just remember to keep your position sizes small.

You can also use these ETFs to hedge your long exposure to oil or Chinese stocks inside of an IRA or other tax exempt vehicle where you don’t want to take the loss because there’s no tax benefit.

For most investors that don’t want to be in and out of an ETF in a matter of days, the DB Crude Oil Short ETN $SZO is the best ETF. This ETF is designed to give you inverse exposure to oil over a month.

You find more of the best ETFs with an ETF screener.

Good Investing,

Corey Williams

Note: Corey Williams writes and edits ETFTradingResearch.com. Sign up for our free ETF reports and free e-letter at http://www.etftradingresearch.com/free-sign-up. We’re devoted to helping you make more money from ETFs.

Category: ETFs, Inverse ETFs