5 Best ETFs For November

I grew up attending Kansas City Royals baseball games. I remember watching guys like George Brett, Frank White, and Bret Saberhagen win the World Series in 1985.

I grew up attending Kansas City Royals baseball games. I remember watching guys like George Brett, Frank White, and Bret Saberhagen win the World Series in 1985.

Heck, I still have boxes full of old baseball cards, signed baseballs and baseball bats, and a cheap souvenir batting helmet that I’m not willing to part with.

Thirty years and many losing seasons later, it was great to see the Royals win another World Series this year. They’re once again the best baseball team in the world.

Today, we’re recognizing the 5 Best Technology ETFs for November.

These Tech ETFs have delivered the best 1 month performance. We’re excluding any leveraged ETF.

Here they are…

5 Best ETFs For November Based On 1-Month Performance

- KraneShares CSI China Internet $KWEB – 20.7%

- Guggenheim China Technology $CQQQ – 20.0%

- EMQQ Emerging Markets Internet & Ecommerce $EMQQ – 18.8%

- PowerShares NASDAQ Internet $PNQI – 14.3%

- Global X NASDAQ China Technology $QQQC – 14.2%

Important Details About The 5 Best ETFs For November

Let’s look at the holdings, amount of money investors have put in the ETF (also called assets under management or AUM), expense ratio, and dividend yield.

KraneShares CSI China Internet $KWEB tracks an index of 56 Chinese internet companies. It has $149.5 million in assets under management. It has an expense ratio of 0.35%. It doesn’t pay a dividend.

Guggenheim China Technology $CQQQ tracks a cap-weighted index of 69 Chinese technology stocks. It includes small, mid, and large cap stocks. It only has $54.6 million in AUM. It has an expense ratio of 0.54%. It has a dividend yield of 0.98%.

EMQQ Emerging Markets Internet & Ecommerce $EMQQ tracks a cap-weighted index of 46 internet businesses in emerging markets. It has a miniscule $11.4 million in AUM. The expense ratio is 0.86%. It doesn’t pay a dividend.

PowerShares NASDAQ Internet $PNQI holds 91 internet companies listed on US stock exchanges. They are weighted according to market-cap. It has $238.6 million in AUM. The expense ratio is 0.60%. It hasn’t paid a dividend.

Global X NASDAQ China Technology $QQQC holds 37Chinese tech stocks weighted according to market capitalization. It has $15.3 million in AUM. The expense ratio is 0.65%. It has a dividend yield of 0.33%.

Can You Make Money With The 5 Best ETFs For November?

Technology ETFs were led higher by Chinese internet stocks like Tencent, Alibaba $BABA, and Baidu $BIDU.

These companies bucked the downtrend in Chinese stocks and delivered impressive gains over the last month.

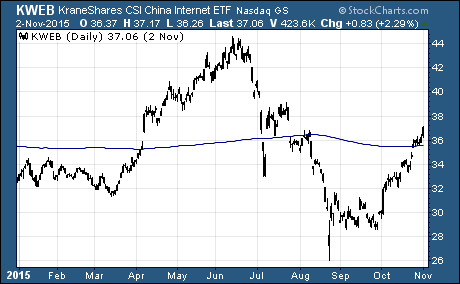

As you can see in this chart of KWEB, Chinese technology stocks have been very volatile this year. The strong gains come from very depressed levels.

It’s hard to say if this is simply a counter-trend rally inside of a downtrend or if the tide has really turned bullish again.

One thing’s for sure, the impressive performance hasn’t drawn investors into these ETFs. The amount of assets in these ETFs is dwarfed by an ETF like the Technology Select SPDR $XLK that has nearly $13 billion in assets under management.

But there’s no denying that ETFs focused on Chinese technology ETFs have been the best performing technology stocks over the last month.

If these ETFs aren’t the best fit for you, you can use an ETF screener to find other ETFs.

Good Investing,

Corey Williams

Note: Corey Williams writes and edits ETFTradingResearch.com. Sign up for our free ETF reports and free e-letter at http://www.etftradingresearch.com/free-sign-up. We’re devoted to helping you make more money from ETFs.

Category: ETFs