7%+ Yields Ahead: Your Smartest Contrarian Play For The Rest Of 2017

If you feel good because your S&P 500 index fund has taken off like a rocket in 2017, you may not want to read this article.

If you feel good because your S&P 500 index fund has taken off like a rocket in 2017, you may not want to read this article.

Because the S&P 500 is, in fact, not doing well this year—at least not compared to its peers.

Don’t believe me?

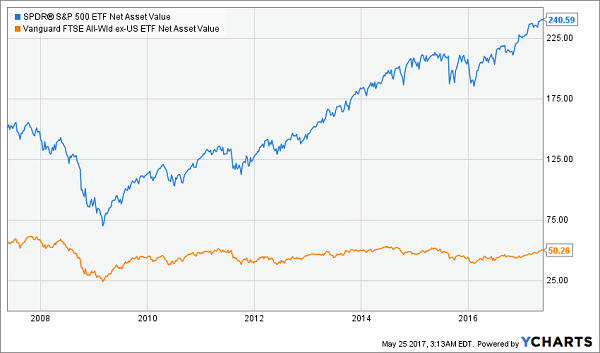

Take a look at the SPDR S&P 500 ETF’s (SPY) performance relative to a global stock fund like the Vanguard Total World Stock ETF (VT):

The World Races Ahead

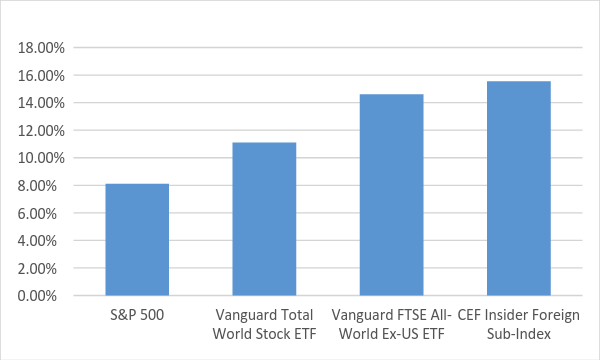

Not only is a global stock portfolio crushing the S&P 500, but US equities are actually dragging the world’s returns down.

Notice how, in the chart above, the Vanguard FTSE All-World ex-US ETF (VEU) is up 14.6%, versus VT’s 11.1% return for 2017? That’s because VEU invests in stocks around the world except for the US, while VT includes American equities.

By bypassing Wall Street, VEU has turned in a year-to-date return that’s almost double that of the S&P 500.

That’s amazing, and no one’s talking about it.

Here’s the best part: you can boost your return even more by going just a half step beyond exchange-traded funds like these three.

For example, there are several closed-end funds that invest in a variety of global assets, just like VEU does, and many of them have the added bonus of handing you yields of 7% or more, too—something ETFs simply can’t match.

Not only do these international CEFs offer bigger dividends, but they’re also outperforming VEU. According to the CEF Insider Foreign Sub-Index, global CEFs are up 15.6% so far in 2017:

Why is this happening?

To answer this question, we first need to get at why global CEFs are beating comparable global-stock ETFs and then look at why global assets are outperforming American stocks generally.

Let’s start with the CEF vs. ETF story.

Many closed-end funds have had a nearly unstoppable run in 2017 after locking in modest gains in 2016. For the most part, this seems to be happening simply because of supply and demand. More investors are eager to buy CEFs now than they were a year or two ago, and that’s driving up these funds’ market prices.

Investors are particularly eager to buy foreign-focused CEFs. As a result, every CEF with an Asian flavor is up more than 10% in 2017, based on their market price. The Asia Tigers Fund (GRR), for example, is up 30.8% year to date, more than tripling up SPY’s return.

But don’t run out and buy GRR—or any other foreign-focused CEF—just yet.

The reason why stems from the way CEFs work. As pools of assets, these funds have a net asset value that is simply the total value of all their holdings. GRR’s NAV is currently $12.97 per share, but if you want to buy a share of GRR, you’re going to pay $12.09.

Sounds great, right? You’re getting GRR’s holdings at a 6.8% discount! In a way, it is great, and this is my favorite thing about CEFs: because of the way they’re set up (specifically that they can’t issue any shares after their IPO), there’s always a variance between their market and NAV prices, and that variance is frequently—but not always—a discount.

The only problem is that some funds always trade at a discount. And in GRR’s case, that discount is usually 12.3% to NAV, or about twice the current markdown! For GRR to go back to its normal valuation, its stock price will need to fall 5.9%.

However, back at the start of 2017, investors were getting GRR at a 15.9% discount to NAV. If you look at a chart of the fund’s NAV and market price for 2017, you can literally see the gap between the two closing:

A Buying Opportunity Goes Poof

This is happening all over the CEF world, sadly, which means it’s getting harder to find discounted assets in this fund class—although they are still there, if a bit fewer and further between.

So that explains half of what’s going on: investors are starving for closed-end funds. But that still doesn’t answer why foreign stocks are, er, trumping their American cousins.

And before you ask, no, the answer isn’t politics. It’s that the rest of the world is finally catching up to America:

When we look at the net asset value of SPY and VEU, we see that the value of foreign stocks is actually still down since before the Great Recession, while US stocks have soared. This is despite China’s meteoric growth and multi-trillion-dollar quantitative easing programs in Japan and Europe.

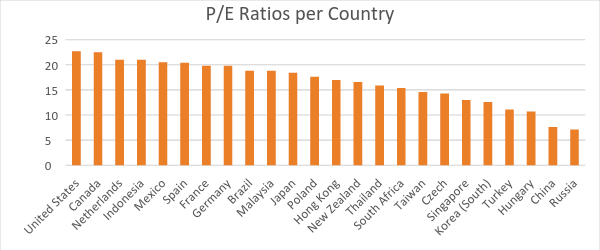

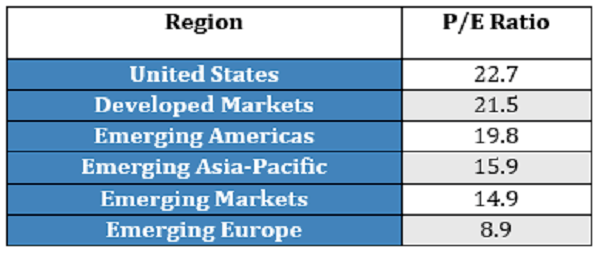

As a result of this long-term equity malaise, US stocks have become some of the world’s most expensive, with a P/E ratio of 22.7, versus absurdly low P/E’s elsewhere, such as that of Chinese stocks (7.6):

Few Bargains at Home

Source: Star Capital, CEF Insider

Only a few advanced economies, like Switzerland, Norway and the United Kingdom, are more expensive than America. Likewise, America is pricier than every region on earth:

Despite those low prices, expectations are getting better for the global economy.

The IMF recently boosted its global economic growth forecast to 3.5%, thanks in part to a big bump in UK growth (2% expected in 2017 versus prior 1.5% expectations, despite the effects of Brexit) and Japan (1.2% versus 1% previously). In their report, the IMF wrote that the outlook has improved for Europe and Japan because of “a cyclical recovery in global manufacturing and trade that started in the second half of 2016.”

Translation: There’s just a lot more economic activity in those parts of the world.

Foreign stocks have not priced this in; going by valuations, things aren’t getting a lot better. Of course, US stocks have been pricing in this “things getting better” trend since 2012, so foreign stocks are playing catch-up quickly—meaning now is the time to get in.

The Retirement Portfolio You NEVER Have to Touch!

What good is a 4%, 7% or even 10% annual dividend yield if you’re racking up similar losses or worse? You need to be averaging roughly 8% in overall annual returns, which means any investments that are treading water or losing ground are literally setting back your retirement timetable, sometimes by entire years!

If you want to retire comfortably, you need a multi-tooled portfolio that not only offers big headline yield, but also dividend growth and the potential for capital gains, too!

And you can find these kinds of “triple threat” stocks in my “No Withdrawal” retirement portfolio.

I’ve spent months researching high-yield stocks looking for the ultimate dividend plays that deliver everything we need to build a successful retirement portfolio. I had to weed out numerous yield traps like some of the losers we mentioned above, but it was worth it, because it resulted in this can’t-miss portfolio featuring:

- No-doubt 6%, 7% even 8% yields – and in a couple of cases, double-digit dividends!

- The potential for 7% to 15% in annual capital gains

- Robust dividend growth that will keep up with (and beat) inflation

These are the three most critical elements for any retirement portfolio, because achieving all three allows you to live off income alone while actually growing your nest egg.

Let me show you the path to a no-worry retirement. Click here and I’ll provide you with THREE special reports that show you the path to building a “No Withdrawal” portfolio. You’ll get the names, tickers, buy prices and full analysis of their wealth-building potential!

Category: Closed-End Funds (CEFs)