Avoid These Hot Sectors

Over the last month, we’ve witnessed a major shake up on Wall Street.

Over the last month, we’ve witnessed a major shake up on Wall Street.

Sectors that led the markets higher over the last few years have run into a brick wall. And the sectors that have been lagging behind have become the new leaders.

In other words, momentum growth stocks have fallen out of favor with investors while value and defensive stocks are surging to new highs.

This reversal of fortunes has caught many seasoned professionals with their pants down. Many funds that specialize in investing in momentum growth stocks are scaling back their operations and returning money to investors.

And the funds that have more freedom to invest in things other than growth are reducing risk and putting money into sectors with lower valuations.

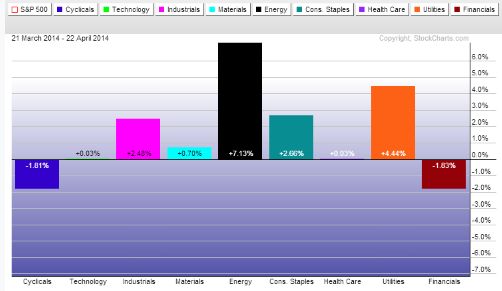

As you can see in the chart below, this has caused sectors like energy, utilities, industrials, and consumer staples to outperform over the last month. And at the same time, consumer discretionary, financials, technology, and health care have underperformed.

It begs the question… which of these outperforming sectors will continue to lead and which will fall back into mediocrity?

For the answer to this question, I’m looking at economic growth.

As the global economy continues to improve, cyclical stocks with low valuations should be the sectors that take on the role of market leaders.

The simple fact that macro economic data continues to improve bodes well for cyclical sectors. Many cyclical companies have high profit margins but slower than normal sales growth.

If economic activity pushes sales growth back to historical norms, we could see earnings for cyclical stocks soar to new heights.

Here’s the upshot…

The way I see it, the strong performance of sectors like utilities and consumer staples will be short lived. But sectors like energy and industrials should continue to outperform in the weeks and months ahead.

Good Investing,

Corey Williams

Category: ETFs, Sector ETFs