A Simple Way To Profit From A Steepening Yield Curve

After the latest Fed statement this week, it’s clear that the Fed will begin to normalize interest rates after years of ZIRP (zero interest rate policy).

After the latest Fed statement this week, it’s clear that the Fed will begin to normalize interest rates after years of ZIRP (zero interest rate policy).

That has big implications for retirees that depend on fixed income investments to generate income. As we leave the unusual days of quantitative easing and ZIRP behind, it’s important to adjust to the new environment.

The Fed’s short term interest rates are expected to begin going up sometime in 2015. And rates are expected to continue moving higher in 2016 and 2017.

What’s more, interest rates on 10-Year Treasury Notes are expected to rise faster than those on 2-Year Treasury Notes. In other words, the yield curve is expected to steepen.

A steepening yield curve will create new ways for investors to profit.

The first take away is financials should benefit from a steepening yield curve. Don’t forget that banking is essentially borrowing short term at a lower interest rate and lending out for a longer term at a higher interest rate. The profit is the margin between the higher and lower interest rates.

The end of ZIRP should increase drive net interest margins up by 2% to 3%. That translates into billions more in profits for the world’s largest banks.

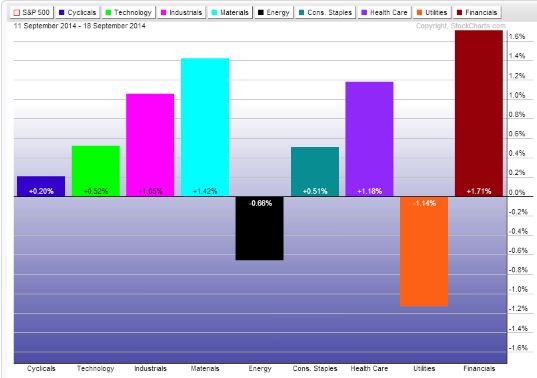

It’s why we’ve seen the financial sector leading the markets higher over the last week.

As interest rates rise and the yield curve steepens, the Financial Select Sector SPDR ETF (XLF) should be a big winner over the next few years.

Another way to profit from the steepening yield curve is the iPath US Treasury Steepener ETN (STPP). This ETN is designed to provide investors with exposure to the Barclays US Treasury 2Y/10Y Yield Curve Index.

This unique ETN uses a strategy designed to capture returns from the steepening of the U.S. Treasury yield curve. It’s a bit complex… it uses notional rolling investment in U.S. Treasury note futures contracts.

The actual performance of the Index is a notional investment in a weighted “long” position in relation to 2-year Treasury futures contracts and a weighted “short” position in relation to 10-year Treasury futures contracts, as traded on the Chicago Board of Trade.

The bottom line is the index is designed to increase in response to a steepening of the yield curve and to decrease in response to a flattening of the yield curve.

STPP reached a 52-week low in August of $35.73. Since then, it has moved up more than 5% to $37.58 today.

These gains are likely to continue in the months ahead as interest rates return to a more normal range.

Here’s the upshot…

Exchange traded products like the Financial Select Sector SPDR ETF and the iPath US Treasury Steepener ETN each provide a unique way for investors looking to profit from the steeping of the yield curve.

Good Investing,

Corey Williams

Category: Bond ETFs, ETFs, Sector ETFs