3 Things You Need To Know In Our July Stock Market Update

I took my family white water rafting down the Colorado River near Glenwood Springs, Colorado over the Fourth of July weekend. It was the first time my wife and I had taken our three boys rafting.

I took my family white water rafting down the Colorado River near Glenwood Springs, Colorado over the Fourth of July weekend. It was the first time my wife and I had taken our three boys rafting.

Thankfully, we had a great guide that told us about all of interesting stuff along the way. But more importantly, he steered us through the rough waters and instructed us when we needed to paddle forward, backward, or just sit back and let the river do the work.

His knowledge of the river, physical conditioning, and the technical understanding of how to manipulate our raft turned a potentially dangerous situation into an exciting and worthwhile adventure for my family.

It’s amazing how much power and intensity the water carries as it flows down the mountain. It reminds me of the financial markets…

No individual person or raft can change the direction of the river or the financial markets. But a good guide can put you in the right situation to avoid danger and make your investing efforts worthwhile.

There’s no doubt that the financial markets hit some white water when the Prime Minister of Greece surprised the markets with a referendum vote. Anything but cash was crushed in the final days of June.

Not surprisingly, the latest AAII Investor Sentiment Survey shows an increase in bearish sentiment. According to AAII, the number of bearish investors shot up 13.4% last week to 35.1%.

I don’t see investor sentiment changing until Greece and the FOMC decisions become more certain. In other words, there’s no reason for the S&P 500 to rip higher in the short term.

Fundamental July Stock Market Update

US economic data continues to show improvement. Last week’s jobs data shows that the US created 223,000 new jobs in June. In other words, it was more of the same slow-growth economy that we’ve seen over the last six years of recovery.

The economy appears to have bounced back after slowing in Q1. Job creation has accelerated, home sales and re-sales have rebounded, and auto sales hit a post-recession high.

Estimates for Q2 GDP growth are now about 2.9%.

Nevertheless, the string of positive and improving economic data has done little to help propel stocks higher due to the uncertainty the Greek sovereign debt crisis has created in the market.

Technical July Stock Market Update

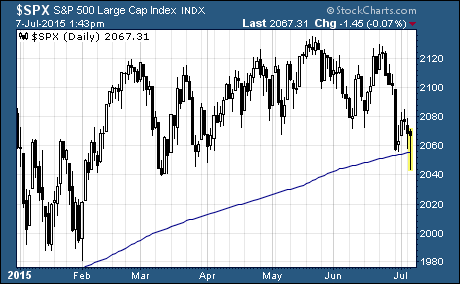

The recent selloff among US large cap stocks has pushed it down to support of the 200-day moving average.

This is the first time since October of last year that the S&P 500 has tested the 200-day moving average. This is a key support level for the S&P 500. It’s one of the most heavily relied upon technical levels.

In short, if the S&P is above the 200-day MA, it is in a long term uptrend. If the S&P is below the 200-day MA, then it’s in a long term downtrend.

More often than not, the 200-day moving average won’t break down on the first test. So, I’m looking for a quick move higher off of this support level.

Key Takeaway From July Stock Market Update

Greece, the Fed, China, and many other factors are weighing on US stock prices in July. I believe these are signs of a much needed transition for the global economy.

We need to see a conclusion to the Greek situation, the Fed needs to hike rates just once to prove it can this year, and China’s stock market needs to stabilize after reaching bubble valuation territory.

I think the next big leg up for stocks will come when we see stabilizing of inflation rates around the world, solid economic growth, and slightly higher interest rates.

The last month has been hard for every asset class but cash. But keep in mind that stocks are still outperforming other asset classes like bonds, commodities, and currencies.

There’s sure to be a bumps and uncertainty along the way but the future is still bright for US stocks in the months ahead.

Good Investing,

Corey Williams

Note: Corey Williams writes and edits ETFTradingResearch.com. Sign up for our free ETF reports and free e-letter at http://www.etftradingresearch.com/free-sign-up. We’re devoted to helping you make more money from ETFs.

Category: Market Analysis