How To Handle An ETF Flash Crash

Investors awoke to a major market selloff on the morning of Monday August 24th, 2015. If you were watching the markets, you’ll recall all of major stock indices plunging 5% or more as soon as the market opened.

Investors awoke to a major market selloff on the morning of Monday August 24th, 2015. If you were watching the markets, you’ll recall all of major stock indices plunging 5% or more as soon as the market opened.

The Dow crashed more than 1,000 points, the S&P 500 was down 120 points, and the Nasdaq was down 393 points within a matter of minutes.

Needless to say, this caught many people off guard.

After all, the US economy has been steadily improving to the point the Fed is nearing the first interest rate hike in nearly a decade.

What Triggered The Market Selloff?

In a word… China.

Economic growth is China has been slowing for years. The boom time of Chinese exports ended with the 2008 financial crisis. China’s government has attempted to prop up their growth rate with a series of questionable actions.

They created a real estate bubble and a shadow banking industry. They built a stock market bubble with cheap and easy to get money in margin accounts.

The air began to come out of the stock market bubble in June. Chinese stocks are 40% below their peak of just a few months ago.

There was little doubt that the Chinese government was buying stocks to try to stem the tide. Then China devalued their currency in a surprise about a week before the US markets’ selloff.

Needless to say, these aren’t normal things for the government to be doing. All of the crazy stuff China was doing caused a lot of investors to believe that another shoe was about to drop.

As a result, there wasn’t anyone that wanted to buy stocks on the morning of August 24th, 2015 as the market opened. The market rout was on… And it could have been even worse.

Circuit Breakers Stopped A Flash Crash

Back in 2010, the US markets had a Flash Crash the wiped out about $1trillion of market value in about 30 minutes of trading.

After that they put in circuit breakers that are designed to slow down dramatic selling. These are triggered when stocks jump or fall by a certain amount in a matter of minutes.

In a normal day, there may be a few halts among all of the stocks traded on US exchanges. But on Monday, there were around 1,200 halts.

These short timeouts did their job… they prevented a major flash crash. But ETFs weren’t so lucky…

ETF Flash Crash

The same circuit breakers kicked in on ETFs as well. But some popular ETFs still plunged much lower than they should have.

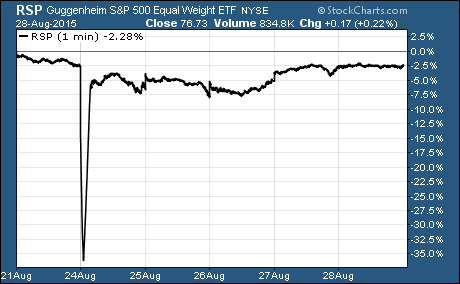

The Guggenheim S&P 500 Equal Weight $RSP is one of those ETFs… it lost 42% of its value in a ‘flash’ during the first few minutes of trading before recovering.

RSP has more than $10 billion in it. If it can be hit by an ETF flash crash, then any ETF is susceptible to a flash crash.

The Lesson Every ETF Investor Needs To Learn

You never want to want to put yourself in a position of being forced to sell at the market price. In other words, don’t use stop losses that sell your open positions at the market price once they are triggered.

Look, markets are imperfect. They always have been and they always will be. That means that the stop losses you have set with your broker won’t perform as you want or expect them to.

It’s better to accept this as the way things are and adjust to it.

You can use mental stops or have your broker’s system notify you by text or email when the value of the ETF drops below a certain price. But you simply can’t use real stop losses with your ETF positions and expect them to perform how you want them to when it really matters.

Good Investing,

Corey Williams

Note: Corey Williams writes and edits ETFTradingResearch.com. Sign up for our free ETF reports and free e-letter at http://www.etftradingresearch.com/free-sign-up. We’re devoted to helping you make more money from ETFs.

Category: Foreign Market ETFs