ETFs To Buy For 4th Quarter Covered Call Writing

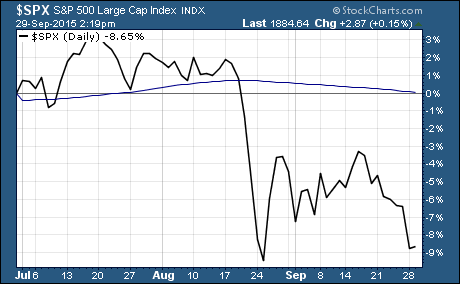

The 3rd quarter was a rough one for stocks. The S&P 500 is down nearly 9% during the quarter. What’s more, the large cap index is down more than 11% from its all-time high. And it fell below the critical technical support of the 200-day moving average.

The 3rd quarter was a rough one for stocks. The S&P 500 is down nearly 9% during the quarter. What’s more, the large cap index is down more than 11% from its all-time high. And it fell below the critical technical support of the 200-day moving average.

Don’t forget, the 200-day moving average is one of the most closely watched trends. Many investors that don’t pay any attention to other form of technical analysis still watch the 200-day moving average. It’s a line in the sand between bullish momentum and bearish momentum.

In short, if the S&P 500 is above the 200-day, these investors are willing to buy. But as soon as it falls below it, they’re selling stocks, or at the very least they’re not buying.

There’s no doubt about it, stocks are facing some serious headwinds right now. Slowing economic growth in China and the impact of lower oil prices is having a negative impact on the global economy.

We’ve seen many economists downgrade their projections for economic growth in the US and around the globe. This less optimistic view is showing up in earnings estimates for companies in the S&P 500.

Nevertheless, we’re seeing some optimism for the S&P 500. Goldman Sachs $GS recently went on record projecting the S&P 500 to finish the year at 2,000. That’s 6% higher than where the S&P is today.

As we put the 3rd quarter in the rearview mirror, it’s time to focus on the future. Let’s see if we can find some ETFs To Buy For The 4th Quarter!

How To Find ETFs To Buy For The 4th Quarter

You can use a covered call strategy with any stock or ETF. But some stocks and ETFs are better than others for this type of strategy.

You can find bigger option premiums from volatile stocks or ETFs. But you stand a bigger chance of your stock ending up above the strike price and having your stock or ETF called away.

I prefer more stable stocks or ETFs… even though you won’t collect as big of an option premium as you’ll see on more volatile investments.

Choosing The Right ETFs To Buy For The 4th Quarter

Two ETFs to consider for your covered call strategy are the Consumer Staples Select Sector SPDR ETF $XLP and the Technology Select Sector SPDR ETF $XLK.

I think both of these ETFs are good ones to own in the current market environment.

Consumer staples are a traditional safe haven. It also pays a 2.65% dividend yield. You should see some solid profits by holding this ETF and writing a covered call against this position.

The Technology Select Sector SPDR ETF is another good choice for a covered call strategy. XLK is dominated by large cap tech stocks that have become some of the steadiest performers. It pays a solid 1.93% dividend yield and you’ll find slightly better option premiums on XLK than you will with XLP.

Covered Call ETFs To Buy For The 4th Quarter

Some of you may not be comfortable using options. Don’t worry, I’ve got a solution for you too…

There are ETFs that used a covered call strategy. The ETF does all of the work for you. You just buy the ETF like any other ETF and all of the work is done inside the ETF.

The most popular ETF that uses a covered call strategy is the PowerShares S&P 500 BuyWrite Portfolio $PBP. It has a little over $300 million in assets under management.

PBP tracks the CBOE S&P 500 BuyWrite Index. It’s designed to give investors returns of a hypothetical covered call strategy on the S&P 500 Index.

It does this by using a hypothetical portfolio consisting of a long position in the S&P 500 and selling a succession of one-month, at- or slightly out-of-the-money S&P 500 call options.

There are a few other ETFs with slightly different covered call strategies. You can use an ETF screener to find them.

Good Investing,

Corey Williams

Note: Corey Williams writes and edits ETFTradingResearch.com. Sign up for our free ETF reports and free e-letter at http://www.etftradingresearch.com/free-sign-up. We’re devoted to helping you make more money from ETFs.

Category: Dividend ETFs