ETFs To Buy If Donald Trump Gets Elected

To be honest, I still can’t believe Donald Trump is seriously running for President of the United States. I’m sure many of you that thought it had to be some type of publicity stunt. It turns out he is leading the way with the most popularity among the many Republican candidates.

To be honest, I still can’t believe Donald Trump is seriously running for President of the United States. I’m sure many of you that thought it had to be some type of publicity stunt. It turns out he is leading the way with the most popularity among the many Republican candidates.

Amazingly, he has a real shot at finding himself in the Oval Office next year.

There is no denying that Trump is a smart businessman. He is hard working and is very vocal on his policies and opinions. This week he announced the Donald Trump Tax Plan.

What does the Donald Trump Tax Plan look like?

He calls it the “1-5-10-15” income tax plan. It consists of the following:

- If you make up to $30,000 you will pay just 1%.

- Income from $30,000 to $100,000 results in a flat 5%.

- $100,000 to 1 million will be taxed at a low 10%.

- Over $1 million or above will be taxed 15%.

Another great feature of his tax plan is that everyone’s tax bill can be filled out on the back of a post card and mailed in. Think of how much money individuals and small business owners will save on accountant fees.

Trump has publically announced that he is ashamed at the way the government spends your tax dollars. He quotes, “The other reason I hate the way our government spends our tax dollars is I hate the way they waste our money. Trillions and trillions of dollars of waste and abuse. And I hate it.”

So Trump decided to make a plan to lower income tax for all Americans.

Now you may be thinking….

Who will benefit the most from the Donald Trump Tax Plan?

The sector that should benefit the most under the Trump tax plan is retail. Under this proposal, it would cut taxes for millions of consumers.

If people can take home more of their paycheck, they’ll have more money for discretionary spending. So, retail stocks should see a nice uptick in sales.

An ETF like the SPDR S&P Retail ETF $XRT is one of a handful of ETFs that focus solely on companies that sell to consumers. You can use an ETF screener to find the others.

But retail stocks are the low hanging fruit. Here’s another ETF that might see an even bigger uptick…

How to really make money off this Donald Trump Tax Plan…

The influx of money into consumers’ pockets isn’t all going to be spent at retailers.

One thing we’ve seen over the last few years is a change in consumer preferences. They’re spending less on material items and more on experiences.

This is a direct result of the 2008 financial crisis. We learned that material items come and go. But memories of great life experiences stay with you forever.

These new consumer behavior trends should have a big impact on one unloved industry… casinos and gambling. And guess who has hotels and high end residential properties in areas devoted to gaming? Donald Trump!

It’s not crazy to think Trump is pushing an aggressive tax policy that would directly benefit his own financial success. He wouldn’t be the great businessman he claims to be if he didn’t!

There’s one ETF dedicated solely to gaming… the Market Vectors Gaming ETF $BJK. In order to be included in this ETF, a company must make at least 50% of their revenue from gaming.

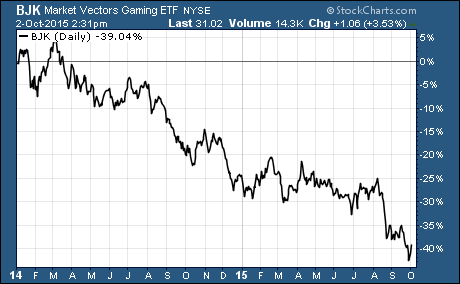

As you can see in the chart, gaming stocks have been taken behind the woodshed since 2013. BJK is down a whopping 40%!

If Trump finds himself as the next President of the United States, it’s a good bet that we’ll see a reversal of this trend.

Good Investing,

Corey Williams

Note: Corey Williams writes and edits ETFTradingResearch.com. Sign up for our free ETF reports and free e-letter at http://www.etftradingresearch.com/free-sign-up. We’re devoted to helping you make more money from ETFs.

Category: What's Going On?