Emerging Market Leveraged ETFs Battleground

The battle between the bears and bulls over emerging markets stocks is heating up. Aggressive traders can use an emerging markets leveraged ETF to pick a side and profit.

The battle between the bears and bulls over emerging markets stocks is heating up. Aggressive traders can use an emerging markets leveraged ETF to pick a side and profit.

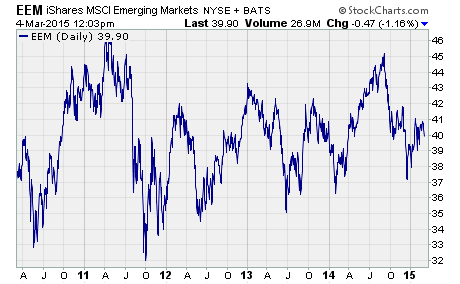

The iShares MSCI Emerging Markets ETF (EEM) has managed a paltry 10% gain over the last five years. That’s less than 2% per year on average. It’s even worse when you consider that the S&P 500 has more than doubled in value during the same time.

Needless to say, emerging markets have been underperforming relative to US stocks for some time now.

Now the bulls and bears are making their case for what the future will bring to emerging markets ETFs.

Here’s what the bulls are saying about emerging market leveraged ETFs…

The discussion about emerging market stocks begins and ends with China.

Their gigantic economy is still rapidly developing. But economic growth has slowed recently as they make the transition from an economy driven by exports to one driven by consumers.

But here’s the thing…

Slowing economic growth and the drop in oil prices have combined to lower the rate of inflation. And without the fear of runaway inflation, the government is free to lower interest rates and introduce new government spending to stimulate the economy.

In fact, we’ve already seen People’s Bank of China cut rates by 25 basis points. And there’s certainly room for more cuts and new stimulus.

These efforts by the Chinese government should be good for Chinese stocks and help lift emerging markets ETFs higher.

And don’t forget about India…

Under the direction of new Prime Minister, Narendra Modi, the country is taking a very corporate and investor friendly stance on economic growth.

In short, his budget and reforms should open the door to faster economic growth.

If China and India ramp up economic growth, they should help fuel a bull market in emerging market ETFs.

Here’s what the bears are saying about emerging market leveraged ETFs…

One thing that emerging markets have no control over is casting a shadow over all of the positive things in favor of emerging market ETFs.

Low US interest rates have been a big help to emerging markets. It has made investing in emerging markets more attractive.

Now investors are beginning to worry about the impact a US interest rate hike will have on foreign investment in emerging markets.

The US Federal Reserve is creeping closer to their first interest rate hike since the financial crisis. But there are signs that investors believe this interest rate hike will happen sometime this year.

If history is any guide, foreign investors will pull out of their investments in emerging markets when the US raises interest rates.

So until the Fed actually raises interest rates, the fear of a selloff in emerging markets will continue to pressure emerging markets stocks lower.

If you think the bulls are right, take a look at buying the Direxion Daily Emerging Markets Bull 3x Shares (EDC). This ETF seeks daily investment results that are triple (300%) the daily performance of the MSCI Emerging Markets Index.

If you think the bears are right, take a look at buying the Direxion Daily Emerging Markets Bear 3x Shares (EDZ). This ETF seeks daily investment results that are triple (300%) the inverse (opposite) of the daily performance of the MSCI Emerging Markets Index.

Good Investing,

Corey Williams

Note: Corey Williams writes and edits ETFTradingResearch.com. Sign up for our free ETF reports and free e-letter at http://etftradingresearch.com/free-sign-up. We’re devoted to helping you make more money from ETFs.

Category: Leveraged ETFs