ETF Traders Are Giving You These 3 High-Yield Stocks At A Discount

For investors who own individual dividend paying stock, it has become difficult to see why share prices move as they do. You probably know the feeling of having one of your stocks make a big move —usually down—and you cannot see any reason for the stock price action. Much of the blame for wild stock swings can be laid at the feet of exchange traded funds and the traders who short-term trade ETFs.

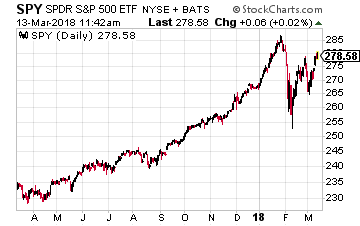

An ETF owns shares of stock to match the components of a specific stock index. For example, the SPDR S&P 500 ETF (NYSE: SPY) owns the 500 stocks in the same proportion as tracked by the Standard & Poor’s 500 stock index. The financial products industry has gone nuts with the development of new indexes to carve up the market into sectors and ETFs to track them. Currently there are over 2,000 ETFs listed in the U.S. The majority —78% of assets—of ETFs are based on stock market indexes. Those assets total over $2.4 trillion. ETF trading has become a very big part of what goes on in the stock markets.

An ETF owns shares of stock to match the components of a specific stock index. For example, the SPDR S&P 500 ETF (NYSE: SPY) owns the 500 stocks in the same proportion as tracked by the Standard & Poor’s 500 stock index. The financial products industry has gone nuts with the development of new indexes to carve up the market into sectors and ETFs to track them. Currently there are over 2,000 ETFs listed in the U.S. The majority —78% of assets—of ETFs are based on stock market indexes. Those assets total over $2.4 trillion. ETF trading has become a very big part of what goes on in the stock markets.

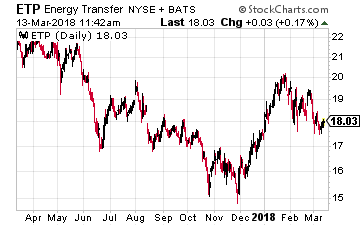

There are two ways ETF action can affect the share values of individual stocks. The most obvious and easy to discern is when the weighting of a stock in an index is changed. One high yield example is Energy Transfer Partners LP (NYSE: ETP), a large cap master limited partnership, commonly abbreviated as MLP. In April 2017, ETP completed a merger with Sunoco Logistics Partners LP, another MLP that was a large component of MLP indexes. Because of the merger, ETFs and index funds tracking MLP indexes were forced to sell significant portions of their ETP holdings to bring the size of the positions down to match the index weightings. This merger was the start of a year long decline in the ETP unit value. Later in 2017, Alerian, the provider of the most popular MLP tracking indexes, changed its methodology to cap Alerian MLP Index constituents to a 10% weight. At that time, ETP’s weight was much higher than 10% in the index, so index tracking funds were again forced to sell ETP units, regardless of investment merit. These forced sales of ETP are the source of much of the 25% value decline over the past year. The company’s fundamentals have been steadily improving, but you could not tell by the market price. ETP currently yields 12.5%.

There are two ways ETF action can affect the share values of individual stocks. The most obvious and easy to discern is when the weighting of a stock in an index is changed. One high yield example is Energy Transfer Partners LP (NYSE: ETP), a large cap master limited partnership, commonly abbreviated as MLP. In April 2017, ETP completed a merger with Sunoco Logistics Partners LP, another MLP that was a large component of MLP indexes. Because of the merger, ETFs and index funds tracking MLP indexes were forced to sell significant portions of their ETP holdings to bring the size of the positions down to match the index weightings. This merger was the start of a year long decline in the ETP unit value. Later in 2017, Alerian, the provider of the most popular MLP tracking indexes, changed its methodology to cap Alerian MLP Index constituents to a 10% weight. At that time, ETP’s weight was much higher than 10% in the index, so index tracking funds were again forced to sell ETP units, regardless of investment merit. These forced sales of ETP are the source of much of the 25% value decline over the past year. The company’s fundamentals have been steadily improving, but you could not tell by the market price. ETP currently yields 12.5%.

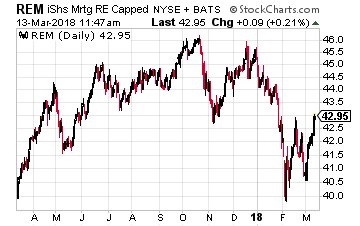

A subtler effect of the ETF boom is that trading of these funds leads to lack of discrimination between the financial results and business prospects. Stocks get lumped together into the ETFs that track specific market sectors. It is tough to figure out whether stock share prices and ETF trading are a chicken and egg dilemma, but it is becoming clearer that increases in ETF trading are tightening correlations, or the tendency for individual stocks and sectors to move up or down in lock step, regardless of a company’s fundamentals. While ETFs account for about 8% of the U.S. stock market value, ETFs are the source of more than 25% of the trading volume. Market observation clearly shows that share prices are greatly affected by short term sector switching by traders. The iShares Mortgage Real Estate ETF (NYSE: REM) provides a couple of examples. Most of the 30 or so stocks in this ETF own leveraged portfolios of residential mortgage backed securities, MBS in industry parlance. This business model is a dangerous game of lending long and borrowing short. This is a group of companies whose finances can be destroyed by a quick change in the yield curve. I recommend against owning any residential MBS focused REITs.

A subtler effect of the ETF boom is that trading of these funds leads to lack of discrimination between the financial results and business prospects. Stocks get lumped together into the ETFs that track specific market sectors. It is tough to figure out whether stock share prices and ETF trading are a chicken and egg dilemma, but it is becoming clearer that increases in ETF trading are tightening correlations, or the tendency for individual stocks and sectors to move up or down in lock step, regardless of a company’s fundamentals. While ETFs account for about 8% of the U.S. stock market value, ETFs are the source of more than 25% of the trading volume. Market observation clearly shows that share prices are greatly affected by short term sector switching by traders. The iShares Mortgage Real Estate ETF (NYSE: REM) provides a couple of examples. Most of the 30 or so stocks in this ETF own leveraged portfolios of residential mortgage backed securities, MBS in industry parlance. This business model is a dangerous game of lending long and borrowing short. This is a group of companies whose finances can be destroyed by a quick change in the yield curve. I recommend against owning any residential MBS focused REITs.

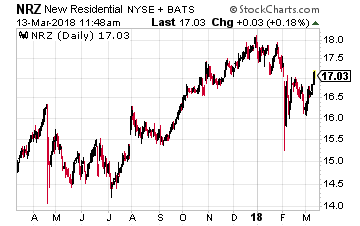

In contrast, the third and fourth heavily weighted stocks in REM are solid companies with business operations that are sustainable through market cycles. In contrast to the rest of the REM portfolio stocks, these two will do even better when short term rates rise. Starwood Property Trust, Inc. (NYSE: STWD) and New Residential Investment Corp (NYSE: NRZ) are very attractive stocks with share prices that have trouble escaping from the trading in REM. STWD currently yields 9% and NRZ is over 11%.

In contrast, the third and fourth heavily weighted stocks in REM are solid companies with business operations that are sustainable through market cycles. In contrast to the rest of the REM portfolio stocks, these two will do even better when short term rates rise. Starwood Property Trust, Inc. (NYSE: STWD) and New Residential Investment Corp (NYSE: NRZ) are very attractive stocks with share prices that have trouble escaping from the trading in REM. STWD currently yields 9% and NRZ is over 11%.

All three of these high yield stocks, ETP, STWD and NRZ, are ones that would likely have higher share prices if not for the power of ETFs in the U.S. stock market. Over the longer term, I expect them to produce superior results in the high-yield universe. In the shorter term, view ETF trading driven dips as buying opportunities on quality stocks with very attractive high yields.

Pay Your Bills for LIFE with These Dividend Stocks

Get your hands on my most comprehensive, step-by-step dividend plan yet. In just a few minutes, you will have a 36-month road map that could generate $4,804 (or more!) per month for life. It’s the perfect supplement to Social Security and works even if the stock market tanks. Over 6,500 retirement investors have already followed the recommendations I’ve laid out.

Click here for complete details to start your plan today.

Category: ETFs