ETFs With Transocean $RIG Exposure

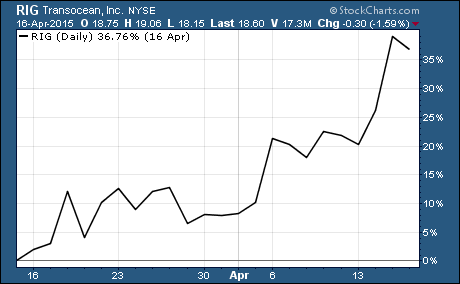

Over the last month, Transocean $RIG is up 35%. That makes it one of the top performing stocks in the S&P 500 during that time.

Over the last month, Transocean $RIG is up 35%. That makes it one of the top performing stocks in the S&P 500 during that time.

ETFs with Transocean are a good way to get exposure to it and other stocks that are similar.

RIG specializes in offshore oil and gas drilling. In short, the company contracts with oil and gas exploration companies to drill wells.

The stock has been moving higher over the last month despite some negative news.

The company announced that they have been forced to renegotiate contracts for their drilling rigs. Many are being cut short due to the drop in oil prices.

As a result, RIG is accelerating their plans to scrap older equipment. The number of floaters they plan to scrap has gone up from 11 at the end of 2014 to 19 in their most recent fleet status report.

The good news is that RIG has a backlog of $19.2 billion of contracts for their offshore oil rigs.

One thing that’s helping RIG and other stocks like it is the recent uptick in oil prices.

Since mid-March, WTIC oil prices have rallied more than 30% from $42.00 to $56.00.

Here are 2 ETFs with Exposure to Transocean…

Market Vectors Oil Services $OIH and SPDR S&P Oil & Gas Equipment and Service $XES both have significant holding of RIG.

RIG makes up 3.35% of OIH. This ETF tracks an index of 25 of the largest US based oil service companies. It has an expense ratio of 0.35% and it’s up 18.4% over the last month.

XES allocates 2.7% of its holdings to RIG. This ETF holds 46 Oil & Gas Equipment & Services stocks in the S&P Total Markets Index. It also has an expense ratio of 0.35% and it’s up 23.1% over the last month.

ETFs with Transocean Holdings…

It’s no surprise that OIH and XES hold some of the same stocks. They both track the oil & gas equipment and services industry.

But they do it in very different ways.

OIH is market cap weighted. So, it gives you exposure to the biggest companies. In fact, more than 70% of this ETF’s holdings are concentrated in the top 10 holdings.

On the other hand, XES is equal weighted. So, all 46 stocks have the same weight in the ETF regardless of the market cap of the stock.

Other ETFs with Transocean Holdings…

There are plenty more ETFs with exposure to RIG. In fact, I see 35 ETFs that hold RIG when I run a screener for ETFs with exposure to RIG.

And ETFs with RIG aren’t the only way to invest in oil ETFs.

Good Investing,

Corey Williams

Note: Corey Williams writes and edits ETFTradingResearch.com. Sign up for our free ETF reports and free e-letter at http://www.etftradingresearch.com/free-sign-up. We’re devoted to helping you make more money from ETFs.

Category: Sector ETFs