Global ETFs/ETPs Hit Record $3.177Tn AUM

ETFGI reports Assets invested in ETFs/ETPs listed globally reached a new record high of 3.177 trillion US dollars at the end of June 2016

ETFGI reports Assets invested in ETFs/ETPs listed globally reached a new record high of 3.177 trillion US dollars at the end of June 2016

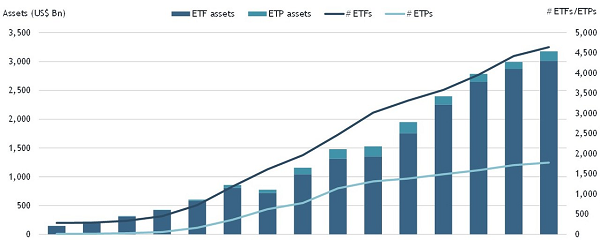

LONDON — July 12, 2016 — ETFGI the leading independent research and consultancy firm on trends in the global ETF/ETP ecosystem, today reported assets invested in ETFs/ETPs listed globally reached a new record high US$3.177 trillion at the end of June 2016. US$31.38 Bn of net new assets were gathered during the month of June marking the 29th consecutive month on net inflows, according to preliminary data from ETFGI’s June 2016 global ETF and ETP industry insights report (click here to view the ETFGI global asset growth chart).

Record levels of assets were also reached at the end of June for ETFs/ETPs listed in the United States at US$2.256 trillion, in Japan which reached US$147.67 billion and in Canada which reached US$79.14 billion.

The Global ETF/ETP industry had 6,424 ETFs/ETPs, with 12,268 listings, assets of US$3.177 trillion, from 284 providers listed on 65 exchanges in 53 countries.

“Markets and investors around the world were engulfed in the chaos following what many saw as the unexpected result of the UK’s June 23rd vote. Volatility was up significantly during the month. The S+P 500 index was up just 0.3%. Emerging markets were up 3.94% while developed markets ex-US declined 2.87%. There is still uncertainty in the markets due to questions on when and how Brexit changes will be implement and the many changes happening in UK political parties” according to Deborah Fuhr, managing partner at ETFGI.

Global ETFs/ETPs saw net inflows of US$31.38 Bn In June

In June 2016, ETFs/ETPs listed globally saw net inflows of US$31.38 Bn. Equity ETFs/ETPs gathered the largest net inflows with US$11.72 Bn, followed by fixed income ETFs/ETPs with US$10.80 Bn, and commodity ETFs/ETPs with US$6.63 Bn. ETF/ETP average daily trading volumes increased by 20.9% from US$81.31 Bn in May 2016 to US$98.33 Bn in June 2016.

YTD through end of June 2016, ETFs/ETPs have seen net inflows of US$122.71 Bn which is significantly below the US$ 152.66 Bn gathered at this point last year. YTD Fixed income ETFs/ETPs have gathered a record level of US$67.63 Bn, followed by commodity ETFs/ETPs which have gathered a record level of US$26.53 Bn, and equity ETFs/ETPs which have gathered US$15.15 Bn.

iShares gathered the largest net ETF/ETP inflows in June with US$13.43 Bn, followed by Vanguard with US$10.02 Bn followed by Nomura AM with US$2.10 Bn net inflows.

YTD, Vanguard gathered the largest net ETF/ETP inflows YTD with US$42.28 Bn, followed by iShares with US$40.51 Bn and Nomura AM with US$7.39 Bn net inflows.

Please visit our website www.etfgi.com to register for future updates and to find ETFGI Press Releases on ETF/ETP industry trends, daily postings of some of the top articles from financial publications around the world.

Note: The post above is drafted by the collaboration of the ValueWalk Team. Click here to visit the site directly.

Category: ETFs