Gold ETFs – Which One Is Right For You?

Gold ETFs are exchange traded funds that are designed to track the price of gold bullion.

Gold ETFs are exchange traded funds that are designed to track the price of gold bullion.

One of the most notable achievements of gold ETFs is that they’ve made it much easier for institutional and individual investors to buy and own investment grade gold.

Prior to the introduction of gold ETFs, the gold bullion market had become virtually inaccessible to private investors. It required large investments as well as the ability to store the gold in an accredited storage vault.

Now, gold ETFs trade on nearly all major stock exchanges around the globe. So you can buy gold for investment right in your brokerage account.

Needless to say, owning a share of a gold ETF that tracks the price of gold is a lot simpler than buying and storing the physical metal on your own.

As a result, the amount of money private individuals and institutions have invested in gold since gold ETFs were introduced has skyrocketed.

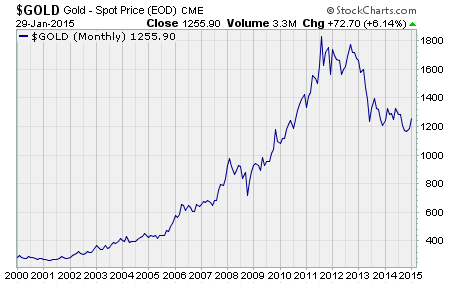

In fact, the demand created by gold ETFs helped drive a decade long bull market from 2001 to 2011. During that time, gold prices soared from $250 to over $1,800 per ounce.

Over the last few years, gold ETFs have lost some of their luster as the price of gold, as well as the amount of money invested in gold ETFs, has fallen.

The most popular gold ETFs…

The surge in gold prices and the success of the first gold ETFs like SPDR Gold Trust (GLD) led to many gold ETFs being launched over the last several years.

But GLD is by far the most popular is terms of assets under management. Today GLD has over $31 billion in assets. That’s 4 times as much as the next biggest ETF, the iShares Gold Trust (IAU) that has around $7 billion in assets.

In total, there are 20 ETFs that are traded on US stock exchanges that track the price of gold. And some of them are great for speculators.

Leveraged gold ETFs…

If you’re a trader looking to play short term fluctuations in the price of gold, you might find leveraged ETFs useful.

A leveraged ETF uses derivatives to deliver investment results that amplify the change in the price of gold and increase the potential gain or loss.

For instance, the ProShares family of ETFs offers two leveraged gold ETFs… ProShares Ultra Gold (UGL) and ProShares UltraShort Gold (GLL).

UGL is designed to move twice as much as the price of gold. So, if gold price go up $1, then UGL should go up $2.

GLL is designed to move twice as much and in the opposite direction as gold prices. So, if gold prices go up $1, then GLL is designed to go down $2.

As you can see, traders who want to speculate on the direction of gold over short periods of time can use leveraged ETFs to increase their profits from a good investment. But keep in mind, leverage cuts both ways… if you’re wrong, you’ll lose twice as much as well.

Currency hedged gold ETFs…

Another recent development is the introduction of gold ETFs that invest in gold by financing the purchases in currencies other than the US Dollar.

The fund family at the forefront of these ETFs is AdvisorShares. The two most popular ETFs of this type are the AdvisorShares Gartman Gold/Yen ETF (GYEN) and the AdvisorShares Gartman Gold/EURO ETF (GEUR).

As you can see, the popularity of gold ETFs has led to a wide variety of gold ETFs. And there’s sure to be one that suits your needs as a long term investor or a short term speculator.

Good Investing,

Corey Williams

Note: Corey Williams writes and edits ETFTradingResearch.com. Sign up for our free ETF reports and free e-letter at http://etftradingresearch.com/free-sign-up. We’re devoted to helping you make more money from ETFs.

Category: Commodity ETFs