This Huge 8.3% Dividend Is Hiding In Plain Sight

With the recent panic, many people fear there’s just no good way to make good money in stocks anymore.

With the recent panic, many people fear there’s just no good way to make good money in stocks anymore.

This is really short sighted!

And dead wrong.

But to make the most profits in a market like this, you simply must choke back your natural instinct to flee when stocks are a sea of red.

To see how being greedy when others are frightened pays off, let me show you a classic example: a fund that holds the very investments that set off the financial meltdown back in 2008. And you’ll probably be shocked to hear that I see them as a screaming buy today.

Talk about contrarian!

We’re going to tap these snubbed investments through an expertly run fund paying a whopping 8.3% cash dividend.

A Hated Buy for 8.3% Dividends and 183% Gains

That fund is the PIMCO Dynamic Income Fund (PDI), a closed-end fund (CEF) focusing on mortgage-backed securities.

Say what?

Let me explain each part.

A CEF is kind of like an ETF or a mutual fund in that it pools cash from investors and uses that cash to buy into a class of assets. Investors can buy or sell shares of the CEF through any retail brokerage, selling when the fund rises in value and buying when it’s lower.

The key difference is that the CEF doesn’t issue more shares to new investors once it goes through an IPO—hence it’s “closed.” This stops the fund from getting too big and straying from its mandate while also ensuring owners’ stake in the fund isn’t diluted.

Enter the Villain

PDI is a CEF that has specialized in mortgage-backed securities, or MBS’s, since its debut in 2012. If you’ve read or seen The Big Short, you might recognize the term: these are the derivatives that were mismanaged so badly that they caused the 2007–09 financial crisis.

Scared yet? I wouldn’t be surprised.

A lot of people were scared of this asset class in 2012, which is why PIMCO launched this fund. They knew there were massive profits to be made because of an overreaction to the crisis, which was by then over and done with. PIMCO also knew that only a few investors would recognize this opportunity, which is why they chose a small CEF instead of a massive mutual fund or ETF.

Here’s how PDI has done since then:

The Ultimate Contrarian Play Pays Off Big

Not only has PDI’s return (in orange) of 182.7% beaten the 135.6% return of the SPDR S&P 500 ETF (SPY) (in blue) since its IPO, but it was even beating Apple (AAPL) in returns until August of this year.

The reason for its recent slump has more to do with market volatility than anything PDI is doing wrong. The fund’s portfolio is up 9.5% from a year ago, including dividends, but because CEFs trade on the market for a different price than their NAV returns (or the value of their portfolio if liquidated today), first-level investors have sold off the fund.

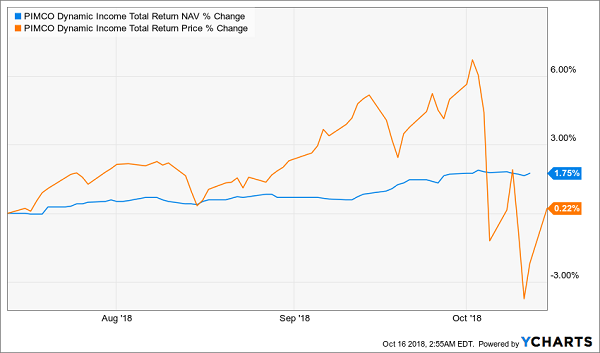

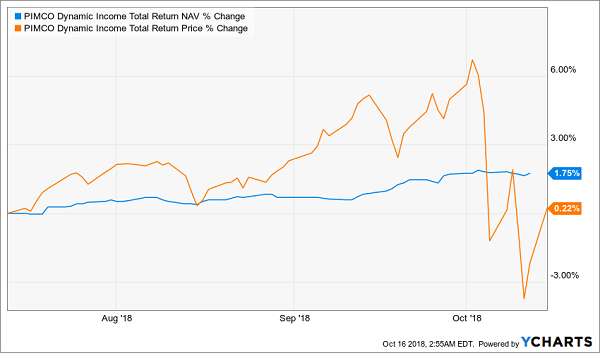

Look at the trend in the fund’s NAV versus its price over the last 3 months:

A Sudden Slump

The sudden drop in PDI’s price, despite the steady rise in its portfolio value, tells us two things: first, it says PDI’s investors have panicked and suddenly sold this fund after overbuying it in prior months. Second, it says that buying a CEF at the right time can dramatically amplify gains.

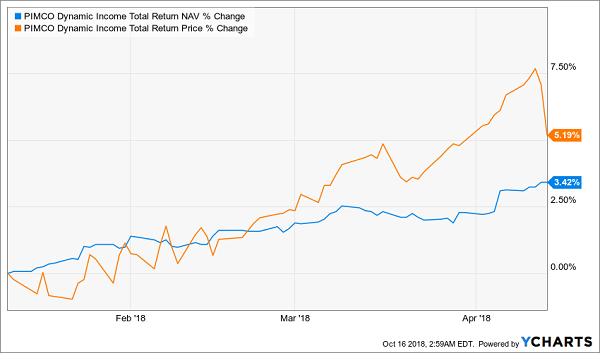

To see what a huge difference timing can make, let’s look at two scenarios. Imagine one person bought PDI on April 11, 2018. He or she would have booked a respectable 5.1% return in just 6 months—a smidgen higher than the S&P 500’s 4.8% gain:

A Decent Profit in a Short Time

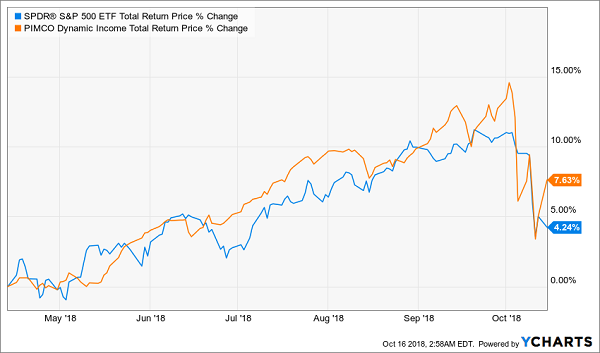

But the investor who bought PDI on April 13, 2018—just 2 days later—would have gotten a 7.6% return over that same period, versus the S&P 500’s 4.2%:

What a Difference 2 Days Makes!

But how could that second investor know to wait 2 days? Again, the beauty of CEFs is that it’s not difficult to time purchases—you just have to look at one metric: the price and NAV return ratio.

Overbought—Then Suddenly Oversold

Note how, from the start of 2018, PDI’s more volatile price returns were staying pretty close to the fund’s NAV until March, when the price trend went far ahead of the NAV trend, causing two big dips in the price in mid-March and then again in mid-April?

Those were entry points to boost returns—which brings me back to this chart:

Buy Window Slides Open

See how the price has suddenly dropped after a big run-up? As in April, PDI is giving savvy investors a shot at outsized gains by jumping in now, when the market has oversold it.

The Truth About 2008

If you have dark memories of 2008, you may be wondering why you would want to bother with an asset class as risky as MBS’s at all.

But 2008 is the precise reason why, because the next crisis never looks like the last one.

The dot-com bubble was a big risk for tech stocks, but real estate and real estate derivatives like MBS’s were relatively fine. Similarly, the 2008 crash was awful for MBS’s and real estate, but tech stocks quickly recovered.

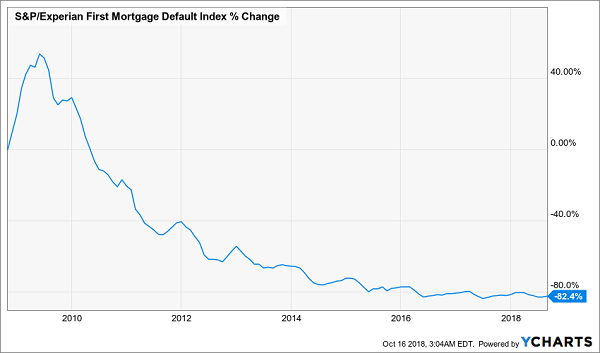

And thanks to 2008, greater regulation and stricter rules have made MBS’s less risky than ever—while strict banking practices also mean mortgage defaults have plummeted—making real estate derivatives safer than they’ve been in a decade:

Mortgage Defaults Fall to the Floor

And all of that is still not priced into MBS’s!

Many of these derivatives are trading far below their intrinsic value, which is why PIMCO, one of the world’s largest and most experienced bond investors, can identify the underpriced ones and buy them at a deep discount, then pass those profits to investors.

If that wasn’t enough to convince you to consider PDI, let me mention the dividend: PDI currently yields 8.3%, and its dividend has risen 24.6% since its IPO.

With a massive yield, market outperformance, a rising income stream and a rare but clear buy signal, PDI is a serious income producer that demands attention.

My colleague Brett Owens has created an “8% No-Withdrawal Portfolio” that generates steady income and impressive capital gains.

Brett’s system could hand you $40,000 a year on every $500,000 invested with under-appreciated income plays like:

- Closed-End Funds (CEFs)- We’ll share our top three CEF picks with you, each of which pay a monthly dividend. Many of these trade at a discount to net asset value; but unlike Oxford Square, actually can afford to pay their dividends.

- Preferred Stock- Brett lets you know two of the best active managers in this space to invest alongside with.

- Recession-Proof REITs- discover two REITs that actually benefit from higher interest rates; rather than being crippled by the Fed.

That’s 7 contrarian investment picks just to get started. Click here for instant access to the full 8%, No-Withdrawal portfolio.

Category: Closed-End Funds (CEFs)