Investing In An Oil ETF

Oil and stocks are moving in lockstep with one another. And oil is the one in control.

Oil and stocks are moving in lockstep with one another. And oil is the one in control.

If oil prices go up, stocks follow. If oil prices go down, stocks follow. If oil has a rare calm day, stocks are flat as well.

It has happened time and time again over the last several months.

The latest news from the oil patch was the Saudis and Russians agreed to fix production at January levels… if, and it’s a big if, other OPEC nations join in.

This could be enough to fix the glut of oil from overproduction. There’s still no indication that all of the other OPEC nations will join in. In fact, Iran called the production freeze “a joke”.

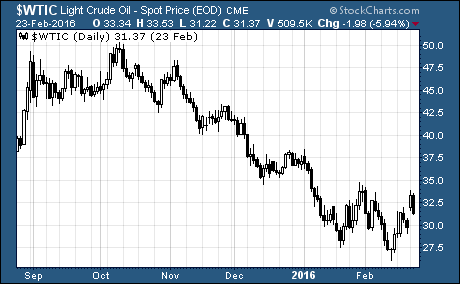

As a result, investors are still waiting to see what will happen. And oil prices ping pong around on a downward trajectory.

Here’s the crazy thing…

Oil and stocks don’t usually trade like this. Over the last decade, there has been no correlation between oil and stock prices. So, why now?

In short, oil’s massive price change is a disruptive force in the markets.

Nobody predicted oil would fall to $30 a barrel. Companies, banks, investors, and anyone else that made business decisions based on assumptions that oil would cost $60, $90, or $120 per barrel is scrambling to reassess the impact of $30 oil.

The ugly truth is the negatives of the massive drop in oil prices drastically outweigh any positive impact of cheap oil and lower gas prices.

There have been fortunes made and lost investing in oil. Right now, fortunes are being lost, but at some point fortunes will be made again.

What’s an oil ETF?

Oil ETFs are exchange traded funds that track the price and performance of oil. But you don’t ever have to own, store, or take delivery of the actual oil.

An oil ETF can come in many shapes, sizes, and be constructed in very different ways.

Some oil ETFs own stocks of oil companies that make money in the oil business. Other ETFs invest in oil futures and derivative contracts so they track the price of oil.

Who should buy an oil ETF?

If you’re looking for a simple way to invest in the oil industry or get exposure to crude oil prices in your investment portfolio, you’ll be interested in oil ETFs.

You can buy an entire basket of oil stocks with the purchase of one ETF.

For example, if you buy the SPDR S&P Oil & Gas Exporation and Production ETF $XOP, then you’re buying all 83 stocks that XOP holds. And you’re doing it in a single trade.

Another popular oil ETF is the United States Oil Fund $USO. USO tracks changes in the price of light, sweet crude oil, as measured by the changes in price of the futures contract on light, sweet crude oil traded on the New York Mercantile Exchange.

Buying an ETF like USO or XOP can be done right in your IRA or brokerage account. And you typically don’t need any special permission to trade these ETFs.

How do I invest in oil ETFs?

As you can see, there are many different types of oil ETFs to choose from.

Here’s how you can find even more oil ETFs.

A good first step is to create a list.

Before you know it, you’ll be ready to invest in your first oil ETF.

Good Investing,

Corey Williams

Note: Corey Williams writes and edits ETFTradingResearch.com. Sign up for our free ETF reports and free e-letter at http://www.etftradingresearch.com/free-sign-up. We’re devoted to helping you make more money from ETFs.

Category: Commodity ETFs