Investors Are Learning That Active ETFs Aren’t An Oxymoron

Anyone who reads financial media has heard time and again that active investing strategies are beginning to die while passive investing has become the law of the land, but things aren’t so simple. Active strategies have certainly been shedding assets at an accelerating pace since the global financial crisis, but there’s one area in which active managers are finding new life.

Anyone who reads financial media has heard time and again that active investing strategies are beginning to die while passive investing has become the law of the land, but things aren’t so simple. Active strategies have certainly been shedding assets at an accelerating pace since the global financial crisis, but there’s one area in which active managers are finding new life.

It’s an area which may be surprising because most investors think of passive strategies when they think of it. The mere thought of actively-managed ETFs seems like an oxymoron, after all.

Another record-setting month for active ETFs and ETPs

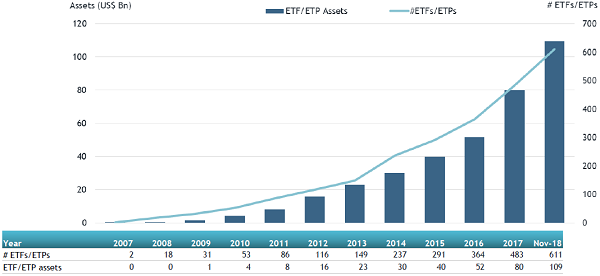

As of the end of November, the world’s active exchange-traded funds and exchange-traded products had $109.39 billion in assets under management, according to data from research and consultancy firm ETFGI. That’s a new record high and follows the previous record set in October when active ETFs and ETPs had $106.09 billion in assets under management.

In November alone, actively-managed ETFs and ETPs racked up $3.64 billion in inflows. The active segment of the global ETF and ETP industry saw a 3.11% increase in total assets invested. ETFGI also said there were 611 ETFs/ ETPs covering 773 listings from 127 providers at the end of November.

Strong continuing growth forecast for active ETFs

Other sources also show how active ETFs are capturing the interest of investors. For example, Dodd Kittsley of Davis Advisors, an early provider of actively-managed ETFs, told Wealth Management that the growth of actively-managed ETFs was more than double the overall market last year, and he expects this trend to continue. However, he also said that as of December, active still represented less than 2% of all the assets held in ETFs.

CNBC has also pointed out the growing interest in active ETFs. Almost a year ago, the news outlet reported that interest in actively-managed ETFs was growing significantly, albeit off a small base. As of March 2018, active ETFs represented a mere 1% of the market, experts estimated at the time.

CNBC also pointed to a survey of institutional investors and financial advisors conducted by BBH, which found a major increase in interest in actively-managed ETFs. More than half of the survey’s respondents expressed interest in using active ETFs in emerging markets, while 45% said they would use them in developed markets overseas.

Here’s how active ETFs work

Actively-managed ETFs are sort of a hybrid investment product which can follow a handful of different strategies. Some providers create ETFs which track their actively-managed mutual fund strategies by building their own index for the fund to track. Other active ETFs combine industry index tracking with active oversight, which many include adjusting the sector allocations based on current market conditions or trading outside the loosely tracked index. In all these cases, the result is a fund which doesn’t exactly mirror the index it tracks like passive ETFs do, although it might come close.

Multiple sources indicate that the vast majority of actively-managed ETFs are in the fixed-income space, but there are some in every strategy. ETF.com reported early last year that the PIMCO Enhanced Short Maturity Active ETF was by far the largest active ETF at the time with $8.3 billion in assets under management.

Benefits and potential barriers to growth for active ETFs

Most investors don’t expect to find active fund management when it comes to ETFs, and it’s easy to see why. However, investors who do buy into an actively-managed ETF do so to enjoy the unique benefits they may offer, such as lower expense ratios and better tax efficiency than mutual funds. In some cases, advisors may steer their clients toward one type of fund for retirement savings and the other type for non-retirement savings.

Active ETFs may also offer more protection from market volatility during extreme periods. However, this reward also brings greater risk than passive ETFs because it means the manager could fail to beat their benchmarks. And like other actively-managed funds, active ETFs usually do charge a premium.

Despite the expectation of continuing strength in the active segment of the ETF industry, there is a major barrier which could be restraining growth in active ETFs, at least for now. In a preview of ETF trends for 2019, Investment Week highlighted growth in active ETFs as a key area of focus. One thing which could be keeping many active managers out of the ETF market is that most countries require full daily portfolio disclosures. Many active managers prefer to keep their current holdings under wraps so their strategy remains a secret, at least until after their thesis plays out.

Note: This article originally appeared at ValueWalk.com. The author of this article is Michelle Jones. Michelle was a television news producer for eight years. She produced the morning news programs for the NBC affiliates in Evansville, Indiana and Huntsville, Alabama and spent a short time at the CBS affiliate in Huntsville. She has experience as a writer and public relations expert for a wide variety of businesses. Michelle has been with ValueWalk since 2012 and is now their editor-in-chief.

Category: ETFs