Sector ETFs To Buy In August

So far the summer of 2015 has been a forgettable one for US stocks. Right now the S&P 500 is up a paltry 3.4% year-to-date.

So far the summer of 2015 has been a forgettable one for US stocks. Right now the S&P 500 is up a paltry 3.4% year-to-date.

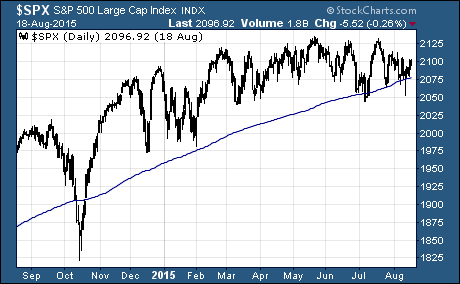

Over the last six months, the large cap index has gyrated up 1%… down 1%… up 2%… down 2%… and going nowhere fast.

What’s more, we’re no longer seeing all sectors moving higher simultaneously. There have been individual pockets of strength and weakness among the sectors.

Healthcare and consumer discretionary have generally been the strongest sectors, while the energy sector has been the weak link thanks to falling oil prices.

More than anything, there’s nothing for investors to be excited about. And the latest economic data did little to change that.

Economic Data Impacting Sector ETFs To Buy In August

There are some good things happening in the economy… US consumers are as healthy as they have been in a decade. The jobs market, retail sales, and housing all reflect the slow and steady growth of the US economy.

But those strengths are offset by concerns about a slowdown in worker productivity, slowing Chinese economic growth, a strong US Dollar, falling oil and commodity prices, and the lack of private and public investment in future growth.

Needless to say, finding the right themes and investments is more critical today than it has been at any other time in the current bull market.

Investor Sentiment Signals Sector ETFs To Buy In August

Another thing to keep an eye on for buy signals is investor sentiment. Over the last few months, a majority of most investors have been sitting on the fence. They’re neither bullish nor bearish on stocks over the next six months.

According to the AAII Investor Sentiment Survey, investors are finally getting off the fence and picking a side. Over the last week, the number of investors on the fence dropped by 10%… 6% of them are now bullish while the other 4% are bearish on stocks.

These fence sitters are likely watching the price action of the S&P 500.

Price Action Signals Sector ETFs To Buy In August

Right now, the S&P 500 is holding above the key 200-day moving average support level.

The 200-day MA and 2,130 resistance mark the lower and upper levels of the trading range.

A breakout through one of these technical levels will likely bring more traders into the market. We could see bullish or bearish activity accelerate quickly depending on which one of these technical levels gives way first.

Recent history suggests that we’re more likely to see a bullish breakout in the near future.

These Are The Sector ETFs To Buy In August

Identifying industries with positive macroeconomic themes is a critical part of the Sector ETF Trader strategy.

Sector ETF Trader identifies high-return potential ETFs based on a number of macro, fundamental, and technical indicators. These indicators offer you the opportunity to participate in some very large moves in a relatively short amount of time.

And because it focuses on ETFs, you get the advantages of both stocks and mutual funds, without the problems of high fees and over-concentration.

Rather than taking a ‘shotgun’ approach to the market, I use a time-tested system like a scalpel to carve out those ‘hidden gems’ with the greatest chance of spectacular profits.

You can develop an ETF trading system like mine or you can let me do the heaving lifting for you.

It’s not too late to pick up the most recent issue of the Sector ETF Trader. But you’ll need to take action now to avoid missing out. Click this link to find out more about this easy method to identifying the most profitable sector ETFs around!

Good Investing,

Corey Williams

Note: Corey Williams writes and edits ETFTradingResearch.com. Sign up for our free ETF reports and free e-letter at http://www.etftradingresearch.com/free-sign-up. We’re devoted to helping you make more money from ETFs.

Category: Sector ETFs