ETFs With Masco $MAS Exposure

Masco $MAS owners are ‘Living Mas’ lately.

Masco $MAS owners are ‘Living Mas’ lately.

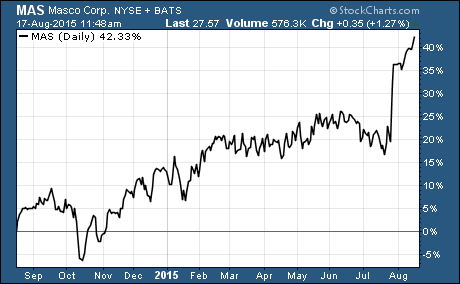

The building material suppliers stock is up 17% over the last month and 42% in 2015. Those impressive gains make it one of the top performing stocks in the S&P 500 over the last month.

Masco is one of the largest manufacturers of brand name products for home improvement and home construction. Their business is a conglomerate of more than 20 companies like Behr, Delta Faucet, and Milgard Windows & Doors.

In fact, we’re seeing all sorts of building material suppliers, construction stocks, and pretty much any stock tied to a housing recovery move higher over the last month.

One industry analyst recently stated that there’s even more upside for these stocks because key variables for a housing recovery are moving in the right direction. The analyst from JPMorgan sighted these three things as positives for the housing industry…

- US job market continues to strengthen

- Consumer confidence remains elevated

- Interest rates remain relatively low

What’s more, mortgage interest rates are already pricing in Fed rate hikes. That means conventional mortgage rates shouldn’t move nearly as much as short term interest rates when the Fed starts to hike the Fed funds rate.

Savvy investors are buying ETFs with Masco and other stocks like it to get exposure to the entire industry.

Here are 2 ETFs with exposure to Masco…

The two ETFs with the largest percentage of the holdings dedicated to MAS are the Direxion iBillionaire Index ETF $IBLN and SPDR S&P Homebuilders ETF $XHB.

MAS is the 3rd largest holding in IBLN. It accounts for 3.84% of the ETF. This unique ETF tracks an index of 30 large-cap U.S. equities that a select group of billionaires have allocated the most assets to according to Form 13F filings. It has an expense ratio of 0.65%. This ETF is unchanged over the last month.

XHB equally weights MAS and 36 other housing market stocks. This ETF has an expense ratio of 0.35%. It’s up 3.2% over the last month.

Other Holdings in ETFs with Masco…

IBLN and XHB have very different holdings outside of their Masco holdings.

The heavy weighting of MAS in IBLN is a clear indication that there are some big money investors that are backing MAS. But IBLN clearly isn’t the best way to play the trend in construction stocks.

XHB is clearly the way to go if you’re looking for an ETF with a big weighting of MAS and focused on the housing market.

Other ETFs With Masco…

There are plenty more ETFs with exposure to MAS. In fact, I see 68 ETFs that hold MAS when I use an ETF screener for ETFs with exposure to MAS.

P.S. I’ve shown my Sector ETF Trader readers dozens of ways to profit from an industry that has fundamental and technical factors in its favor. You can click here for details on how to access my research.

Good Investing,

Corey Williams

Note: Corey Williams writes and edits ETFTradingResearch.com. Sign up for our free ETF reports and free e-letter at http://www.etftradingresearch.com/free-sign-up. We’re devoted to helping you make more money from ETFs.

Category: What's Going On?