10 High-Yield Stocks To Diversify Your Portfolio

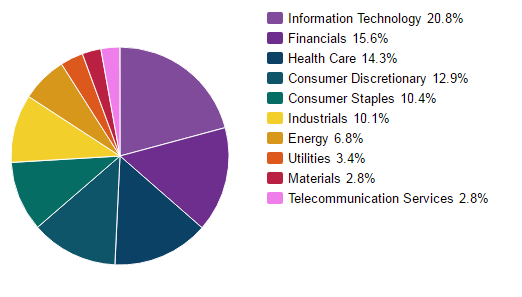

If your portfolio crashed because of too much exposure to the energy sector during the recent downturn, increasing your portfolio’s diversification to a variety of sectors can prevent that from happening again. These ten stocks cover almost all of the sectors that can be invested in.

If your portfolio crashed because of too much exposure to the energy sector during the recent downturn, increasing your portfolio’s diversification to a variety of sectors can prevent that from happening again. These ten stocks cover almost all of the sectors that can be invested in.

As an income stock focused analyst, most of my research and resulting stock recommendations come out of a small group of market sectors. For higher yields, investors end up owning a lot of the tax-advantaged, pass-through structured companies. These tax structures are limited to a few types of businesses including real estate investment trusts (REITs), business development companies (BDCs), and energy infrastructure companies organized as master limited partnerships (MLPs).

Since my income stock recommendations mostly come out of this small group of business sectors, I often get the question on whether my total number of newsletter recommendations provide enough market sector diversification. I have two basic answers to that question. First, my research has shown that a portfolio of moderate-to-high-yield stocks with growing dividend payments will provide above average total returns through the range of market cycles. It is a much surer approach to stock market investing compared trying to time bottoms and tops of no or low yield stocks. Second, the different REIT sectors can actually provide investment exposure to most of the stock market sectors. Standard and Poor’s divides the S&P 500 stocks into 10 different sectors. Let’s see how many we can cover out of the pass-through income stocks universe:

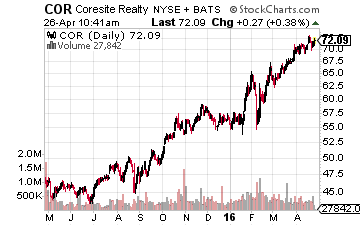

Technology is the largest sector in the S&P 500. REITs have this sector covered with the data center operator companies. Investment choices here range from large-cap conservative, like Digital Realty Trust, Inc. (NYSE:DLR),

Technology is the largest sector in the S&P 500. REITs have this sector covered with the data center operator companies. Investment choices here range from large-cap conservative, like Digital Realty Trust, Inc. (NYSE:DLR), which yields 4% and is growing dividends at 4% to 5% annually, to small, fast-growth companies such as CoreSite Realty Corp (NYSE:COR), which increased its dividend by 27% in the last year and yields just under 3%.

which yields 4% and is growing dividends at 4% to 5% annually, to small, fast-growth companies such as CoreSite Realty Corp (NYSE:COR), which increased its dividend by 27% in the last year and yields just under 3%.

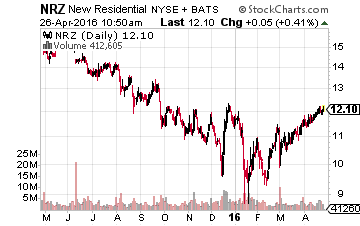

The financial sector is covered by the finance REITs. These companies provide loans and other services primarily to the residential and commercial real estate sectors. New Residential Investment Corp (NYSE:NRZ) with its 15% yield and Blackstone Mortgage Trust Inc. (NYSE:BXMT), yielding 9.3%, give your income portfolio a slice of this sector.

Related: How to collect $3,594 on average for every month in 2016.

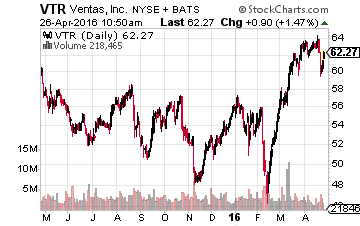

Healthcare REITs is one of the larger commercial property sectors. These companies own hospitals, acute care centers, medical office buildings, senior nursing facilities, and assisted living centers. Out of the many healthcare REIT choices, Ventas, Inc. (NYSE:VTR), yield 4.8%, and Omega Healthcare Investors Inc. (NYSE:OHI), yield 6.7%, have given investors years of steady dividend increases.

Healthcare REITs is one of the larger commercial property sectors. These companies own hospitals, acute care centers, medical office buildings, senior nursing facilities, and assisted living centers. Out of the many healthcare REIT choices, Ventas, Inc. (NYSE:VTR), yield 4.8%, and Omega Healthcare Investors Inc. (NYSE:OHI), yield 6.7%, have given investors years of steady dividend increases.

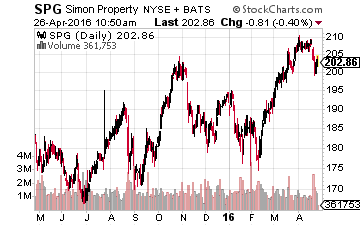

The shopping center REITs have the consumer discretionary sector covered.  Simon Property Group Inc. (NYSE:SPG) is a $60 billion market value large cap company that continues to grow dividends at a mid-teens annual rate. The shares yield 3.2%. Brixmor Property Group Inc (NYSE:BRX) owns neighborhood and community shopping centers. The places where we all shop every week. BRX yields 3.9% and has been a high single-digit dividend grower.

Simon Property Group Inc. (NYSE:SPG) is a $60 billion market value large cap company that continues to grow dividends at a mid-teens annual rate. The shares yield 3.2%. Brixmor Property Group Inc (NYSE:BRX) owns neighborhood and community shopping centers. The places where we all shop every week. BRX yields 3.9% and has been a high single-digit dividend grower.

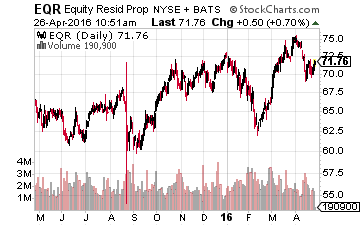

To cover the consumer staples market sector, consider the housing REITs. Apartment owning REITs provide the very basic need of a place to live.  The construction of new apartment complexes also results in continued sales of staples products such as large appliances. Equity Residential (NYSE:EQR) is a $25 billion market cap apartment REIT that has generated 10% annual dividend growth for investors. The stock yields 2.8%.

The construction of new apartment complexes also results in continued sales of staples products such as large appliances. Equity Residential (NYSE:EQR) is a $25 billion market cap apartment REIT that has generated 10% annual dividend growth for investors. The stock yields 2.8%.

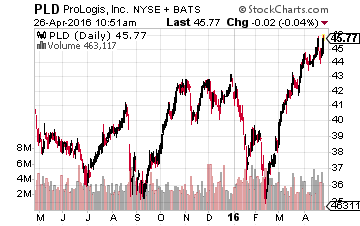

The industrial sector is covered by the warehouse and industrial REITs. Large-cap Prologis Inc (NYSE:PLD) provides an international portfolio of warehouse and distribution centers.  PLD grew its dividend by 21% last year and yields 3.8%. Stag Industrial Inc (NYSE:STAG) owns industrial properties across the secondary and tertiary markets in the U.S. STAG is a 3% to 4% annual dividend grower and yields 7.0%.

PLD grew its dividend by 21% last year and yields 3.8%. Stag Industrial Inc (NYSE:STAG) owns industrial properties across the secondary and tertiary markets in the U.S. STAG is a 3% to 4% annual dividend grower and yields 7.0%.

Listed above are REIT investment ideas for six of the ten S&P sectors. Energy, Utilities and Telecom Services all have their own high yield investment choices. In fact, REITs offer even more sector investments that can give you a more diversified portfolio. The self-storage REITs are some of the best growth prospects in the entire stock market. Hotel/lodging REITs are a way to play GDP growth and recessions.

Finding stable companies that regularly increase their dividends is the strategy that I use myself to produce superior results, no matter if the market moves up or down in the shorter term. The combination of a high yield and regular dividend growth is what has given me the most consistent gains out of any strategy that I have tried over my decades-long investing career.

And, there are currently over twenty of these stocks to choose from in my Monthly Paycheck Dividend Calendar, an income system used by thousands of dividend investors enjoying a steady stream of cash.

The Monthly Dividend Paycheck Calendar is set up to make sure you receive a minimum of 5 paychecks per month and in some months 8, 9, even 12 paychecks per month from stable, reliable stocks with high yields.

The Calendar tells you when you need to own the stock, when to expect your next payout, and how much you can make from stable, low-risk stocks paying upwards of 12%, 13%, even 15% in the case of one of them. I’ve done all the research and hard work, you just have to pick the stocks and how much you want to get paid.

The next critical date is Thursday, May 5th (it’s closer than you think), so you’ll want to take action before that date to make sure you don’t miss out. This time, we’re gearing up foran extra $3,158.30 in payouts by June 15th, but only if you’re on the list before May 5th. Click here to find out more about this unique, easy way of collecting monthly dividends.

Category: REITs