10 Most Popular Private Investment Strategies For 2017

We recently undertook a survey to determine the private investment strategies most likely to attract allocations over the next 12-months.

We recently undertook a survey to determine the private investment strategies most likely to attract allocations over the next 12-months.

Here are the results and our commentary.

The response to our survey was overwhelming and it took me some time to collate.

While I’m no statistician it is worth mentioning the methodology I employed.

The survey went out to over 100 allocators of capital including institutional investors, family offices, wealth managers and high-net worth individuals with a 45% response rate.

The responses were split approximately 20%/30%/30%/20% according to the above investor types respectively.

Most respondents provided multiple answers to the question – “Which strategy are you most likely to allocate to over the next 12 months?”

In order to compile the results below I added up all the answers and calculated the percentage by strategy.

It seems I captured most of the pertinent strategies in the options provided but 4 additional investment strategies were furnished under the ‘other’ option.

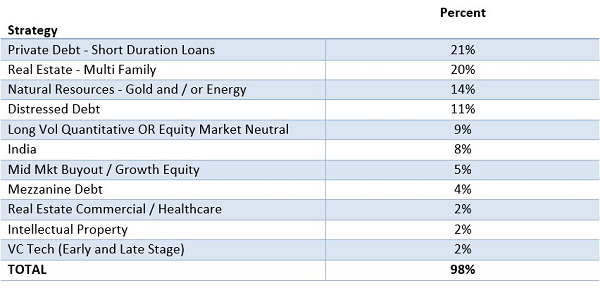

The Results … Drumroll

It may come as little to no surprise that we are all clamoring for yield compliments of the Federal Reserve and ultra-low interest rate environment.

In 1st place with 21% of the votes is Private Debt – Short Duration Loans;

Closely followed in 2nd place by Real Estate – Multi Family Properties with 20% of the votes.

It seems as if hardly any of us are hunting elephant returns which admittedly is more a representation of the clients we serve i.e. pools of capital focused primarily on capital preservation and a real rate of return.

Quite a distance behind, in 3rd place, with 14% of the votes is Natural resources – Gold and/or Energy. Two reasons potentially stand out for this.

1 – Gold & Silver has been on a tear lately and are exhibiting a negative correlation to equities – a hedge;

2 – Most of us are value based investors and recognize a bargain when we see one.

In fact I would postulate that most of us are quite defensively positioned in our portfolios because the next 2 favored investments strategies were:

- Distressed Debt – 11% and;

- Long Volatility Quantitative OR Equity Market Neutral strategies 9%

Interestingly the lower end of the voting table all contained what I would characterize as ‘risk on’ strategies focused mostly on capital appreciation with some income component:

- India (and other EM) 8%;

- Private Equity / Growth and buyout 5%;

- Mezzanine Debt 4%;

- Intellectual Property Rights 2%;

- Venture Capital (early and late stage) – only 2% – this was a surprise considering how hot this space has been until recently;

- And finally other Real Estate including office, industrial, healthcare – 2%

- Nobody included Legalized Cannabis J as an option

For the auditors amongst us that adds up to 98%. The difference I would ascribe to rounding or a margin of error in the poll rates … which we know is meaningless unless this was a Brexit vote!

Where to from here?

Firstly – we did not consider the optimal investment vehicle choices. Most respondents I am guessing are consumers of private placement limited partnership structures although more than a few would use separate accounts or require a regulated vehicle such as mutual fund or ETF.

And of course not everyone would use a fund … many respondents prefer a direct or co-investment approach. [Our preference is for a mix].

Secondly – We did not consider the characteristics we would look for in a potential investment manager in those respective strategies. Our preference for managers broadly is:

- Boutique Managers;

- Historical record of adding value (200 – 300 bps per year above some benchmark);

- Deep understand of and ability to communicate the Risk of the investment and business model;

- Considerable investment by the partners of the manager.

We think both points have merits and are worthy of further research on their own.

Thank you to all who participated I found the results interesting and informative and I hope you do too.

Warm Regards

Greg Silberman

Note: Greg Silberman is a contributor to ValueWalk.com.

Category: What's Going On?