Leveraged Natural Gas ETF Battleground

Over the last few weeks, the battle between the bears and bulls over natural gas prices has been heating up. Aggressive traders can use a leveraged natural gas ETF to pick a side and profit.

Over the last few weeks, the battle between the bears and bulls over natural gas prices has been heating up. Aggressive traders can use a leveraged natural gas ETF to pick a side and profit.

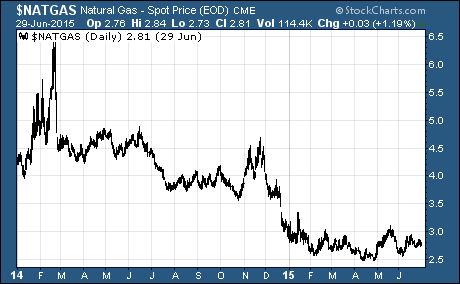

As you can see, natural gas prices have been moving lower since early on in 2014.

Now the bulls and bears are making their case for what the future will bring to natural gas prices and leveraged ETFs that track the price of the commodity.

What The Bulls Are Saying About Leveraged Natural Gas ETFs…

Natural gas is quickly replacing coal as the main fuel source for electricity production. From 2005 and 2012, the share of electricity produced by natural gas soared from 19% to 30%. At the same time, coal’s share fell from 50% to 37%.

Gas demand from power plants has averaged nearly 29.4 billion cubic feet per day in June. That’s a whopping 23% increase from the last year at this time.

And a recent ruling from the US Supreme Court ruling should provide an additional boost to the use of natural gas for electricity production. In other words, the growth we have seen in recent years isn’t slowing down any time soon.

Here’s the thing…

The latest weather forecasts are predicting summer temperatures to be hotter than previously expected. That means more air conditioners will be pumping out cold refreshing air across the US over the next month.

The demand for more electricity to crank up the A/C will also mean more natural gas being used. According to the Wall Street Journal, “prices for the front-month August contract settled up 2.7 cents, or 1%, to $2.832 a million British thermal unit on the New York Mercantile Exchange. It is gas’s fourth winning session in the past five.”

In short, look for hot weather to send the price of natural gas higher in the weeks ahead.

What The Bears Are Saying About Leveraged Natural Gas ETFs…

There’s no doubt that natural gas is more essential than ever for electricity production. And it’s true that hotter than expected weather will increase demand for natural gas.

But there’s just one problem… supply.

Natural gas inventories have remained high even though we are using more of it than ever to produce electricity. And production of natural gas hasn’t fallen much from the record highs even as prices have fallen.

Simply put, production growth is outpacing consumption growth. And there’s already a glut of nat gas in storage.

Traders looking to profit from this should look for prices to go lower, not higher, in the weeks ahead.

Leveraged Natural Gas ETFs To Pick A Side And Profit…

If you think the bulls are right, take a look at buying the ProShares Ultra Bloomberg Natural Gas $BOIL. This ETF seeks daily investment results that are two times (200%) the daily performance of the natural gas futures.

If you think the bears are right, take a look at buying the ProShares Ultrashort Bloomberg Natural Gas $KOLD. This ETF seeks daily investment results that are two times (200%) the inverse (opposite) of the daily performance of natural gas futures.

Not ready for a leveraged ETF? Take a look at these natural gas ETFs…

Good Investing,

Corey Williams

Note: Corey Williams writes and edits ETFTradingResearch.com. Sign up for our free ETF reports and free e-letter at http://www.etftradingresearch.com/free-sign-up. We’re devoted to helping you make more money from ETFs.

Category: Leveraged ETFs