April ETF Fund Flows Are Bad For US Stock Funds

May is here… and that can only mean one thing, the ‘sell in May and go away’ crowd will be out if full force.

May is here… and that can only mean one thing, the ‘sell in May and go away’ crowd will be out if full force.

Let’s take a look at the April ETF fund flows and other sentiment indicators for clues to the market’s next move.

ETF fund flows are a valuable indicator of what traders are thinking. It takes a lot of buying or selling to drive millions or even billions of dollars into or out of individual ETFs.

Fund flows are something traders use to find trends and gauge investor sentiment. And it can help you pinpoint which ETFs could be next to make a big move higher or lower.

The Emotion Driving April ETF Fund Flows…

We monitor several fundamental and technical indicators of fear and greed. And we’re seeing a lot of mixed signals.

We’re seeing some indicators of greed like strong demand for junk bonds and cyclical growth stocks outperforming safe haven stocks.

But we’re also seeing indicators of fear like increased put option buying and a loss of bullish market momentum.

Neither fear nor greed has a firm control of the market right now.

The ETFs With The Largest Inflows In April…

For the third month in a row, ETFs that hold non-US stocks have enjoyed the largest net inflows.

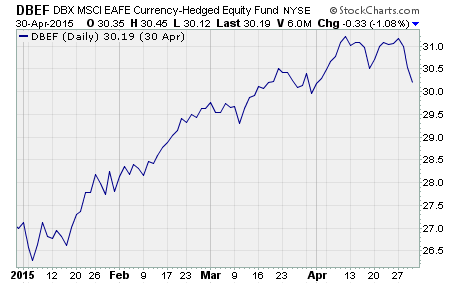

Deutsche X-trackers MSCI EAFE Hedged Equity ETF $DBEF and WisdomTree Europe Hedged Equity $HEDJ led all ETFs with $4.2 billion and $2.8 billion in net inflows in April.

Both of these ETFs both hedge against currency fluctuations. So, US investors don’t have their returns earned in foreign currencies hurt by a strong US Dollar.

DBEF tracks an index of stocks from developed countries outside of the US and Canada. HEDJ tracks an index of European stocks.

One thing’s for sure, investors are increasingly turning to non-US stock investments.

The ETFs With The Largest Outflows In April…

The same theme of investors favoring non-US stock ETFs can be seen in the outflows from some popular US stock ETFs. April redemptions were led by SPDR S&P 500 $SPY and iShares Russell 2000 $IWM.

SPY had a whopping $13.2 billion in net outflows and IWM had $3.4 billion in outflows.

Right now, investors are in wait and see mode toward US stocks. The US economy isn’t growing as fast as expected. But inflation is low and companies have shown the ability to engineer earnings growth without revenue growth.

As a result, neither fear nor greed is dominating investors’ actions.

The neutral outlook toward US stocks is driving investors out of US stock ETFs and into ETFs the hold foreign stocks. Additionally, investors are taking advantage of ETFs that offer currency hedging to offset the strong US Dollar.

These market conditions will likely persist through the 2nd quarter as investors wait for more clarity on US growth prospects and turn toward non-US investments that have the potential to outperform after lagging US stock returns for several years.

Good Investing,

Corey Williams

Note: Corey Williams writes and edits ETFTradingResearch.com. Sign up for our free ETF reports and free e-letter at http://www.etftradingresearch.com/free-sign-up. We’re devoted to helping you make more money from ETFs.

Category: Market Analysis