Cyclical Sector ETFs Take The Lead

Over the last week, the S&P 500 hasn’t done much.

Over the last week, the S&P 500 hasn’t done much.

The large cap index started at 1,869 and closed at 1,867 yesterday. And it traded in a tight 32 point range over that time.

But underneath the surface, there are some interesting things going on.

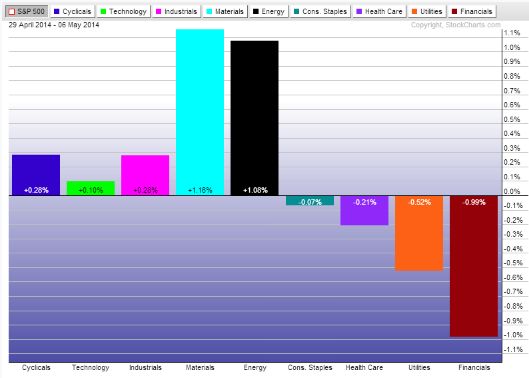

Just take a look at this chart of the relative performance of the nine Select Sector SPDR ETFs that make up the S&P 500.

As you can see, there are some big differences in the performance of individual sectors…

The weakest sectors over the last week are financials, utilities, and health care. At the same time, the materials and energy sectors were the strongest performers.

Financials were by far the weakest sector last week. They underperformed the S&P by a full percentage point.

This sector has been hurt by a flurry of bad news and poor earnings. For instance, Bank of America (BAC) recently announced they made a $4 billion error in calculating the amount of capital the bank has. And fellow bank JPMorgan Chase (JPM) said a drop in trading activity would drag down their profits.

What’s more, a recent report from The Boston Consulting Group suggests that profits on Wall Street could take a big hit as the final adoption of the Dodd-Frank regulations is implemented.

The combination of poor earnings, bad news, and an outlook for even slimmer profits made financials the worst performing sector of the S&P 500 last week.

The good news is outside the financial sector, there were some strong performances from cyclical sector ETFs. The energy and materials sector ETFs both outperformed the S&P 500 by more than 1% last week.

In fact, the basic materials ETF has been quietly outperforming the S&P 500 since the middle of last year. But the outperformance of energy is something that has materialized quickly over the last few months.

It’s not surprising to see these sectors doing well. These sectors are dependent on commodity prices. And so far this year, commodities like precious metals, oil & gas, as well as grains and softs, have enjoyed a nice run to the upside.

It’s no secret that commodity prices are moved by supply and demand, or in the case of futures, the expectation of future supply and demand.

In oversimplified terms, the increase in the price of a commodity reflects the expected increase in demand or decrease in supply of that commodity.

There are some commodities, like coffee, that have benefited from supply disruptions. And others, like gold, that are benefiting from uncertainty.

But in general, rising commodity prices and an uptick in cyclical stocks, like basic materials and energy, reflect the expectation that economic activity will create more demand for these products.

Here’s the upshot…

Even though the S&P 500 has done much over the last week, there are big differences among sector performance.

Right now the place to be is in cyclical sectors that will benefit the most from an uptick in economic growth.

Good Investing,

Corey Williams

Category: ETFs, Sector ETFs