ETFs With Newmont Mining (NEM) Exposure

The recent uptick in the price of gold has sparked a rally in gold mining stocks.

The recent uptick in the price of gold has sparked a rally in gold mining stocks.

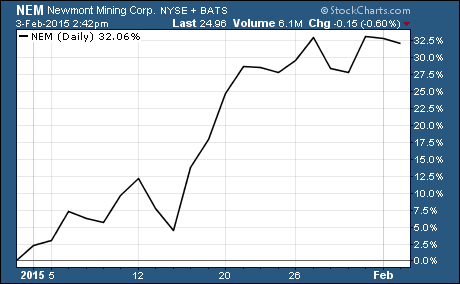

In fact, Newmont Mining (NEM) is the best performing stock in the S&P 500 so far this year. It’s up 32.8% year-to-date to $24.96 per share.

ETFs with Newmont Mining exposure are a good way to add NEM and other gold mining stocks to your portfolio.

Here are 3 Gold Miners ETFs with Exposure to Newmont Mining…

The three ETFs with the largest weighting of NEM are iShares MSCI Global Gold Miners ETF (RING), PowerShares Global Gold and Precious Metals Portfolio (PSAU), and Market Vectors TR Gold Miners (GDX).

iShares’ RING has the largest weighting of NEM with 8.98% of the holdings invested in this stock. PowerShares’ PSAU has slightly less with 7.16% of the holding devoted to NEM. And Market Vectors’ GDX has the smallest of the three with 6.29% of the fund devoted to NEM.

As you can see, these three ETFs all have a decent amount of exposure to NEM.

Gold Miners ETFs with NEM Expense Ratios…

One way to differentiate these ETFs is based on expense ratio.

RING has the lowest expense ratio of 0.39%. It’s not surprising to see an ETF from iShares have the lowest cost. They are one of the biggest ETF providers around, so they compete based on their size and cost advantages over other ETF providers.

PSAU has the highest expense ratio at 0.75%. PowerShares competitive edge is smart beta or alternative indexing strategies. And they typically charge a higher fee for these services.

GDX’s expense ratio is 0.53%. That’s essentially right down the middle between iShares low fee and PowerShares high.

Gold Miners ETFs with NEM Holdings…

Is there a noticeable difference among the holdings of RING, PSAU, and GDX that justifies the higher expense of these ETFs?

RING holds NEM and 40 other stocks from both developed and emerging markets that derive the majority of their revenues from gold mining.

PSAU tracks an index of 68 globally traded stocks. These are the largest and most liquid companies involved in gold and other precious metals mining-related activities.

GDX tracks an index of 40 stocks. It is designed to provide exposure to a diversified blend of small-, mid-, and large-capitalization stocks that are primarily involved in mining for gold.

As you can see, there are some differences between the percentage weight of NEM, other stock holdings, and expenses of these three gold miners ETFs with exposure to NEM.

Which of these ETFs is best?

For me, it boils down to performance…

So far this year, RING is the top performer of these ETFs. It also has the highest weighting of NEM and the lowest expense ratio.

In short, if you’re looking for a gold miners ETF with exposure to NEM, then RING is the way to go.

Good Investing,

Corey Williams

Note: Corey Williams writes and edits ETFTradingResearch.com. Sign up for our free ETF reports and free e-letter at http://etftradingresearch.com/free-sign-up. We’re devoted to helping you make more money from ETFs.

Category: Sector ETFs