ETFs With Amazon $AMZN Exposure

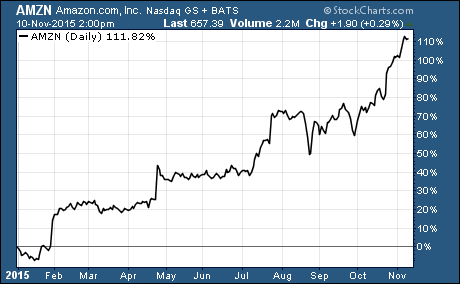

Amazon $AMZN stock is up 111% this year. The impressive stock performance has lifted the company’s stock to over $655 per share and their market cap is more than $307 billion.

Amazon $AMZN stock is up 111% this year. The impressive stock performance has lifted the company’s stock to over $655 per share and their market cap is more than $307 billion.

Needless to say, AMZN has come a long way since its IPO in 2002 that valued the company at $400 million. They are now the dominant force in online retailing with revenues that are doubling on a yearly basis.

The strong performance of AMZN and a handful of other mega-cap stocks are the main reason that the S&P 500 is up this year. In fact, the 10 largest stocks in the S&P 500 are responsible for all of the gains.

The S&P 500 index weights each stock according to market capitalization. So companies like AMZN, with their massive market cap, have a big impact on the index.

It’s also why the Guggenheim S&P 500 Equal Weight ETF $RSP is down year-to-date. RSP gives an equal weighting to each stock in the S&P 500 regardless of the company’s market capitalization.

Let’s take a look at three ETFs that have the most exposure to AMZN.

Here are 3 ETFs with exposure to Amazon stock…

Market Vectors Retail ETF $RTH is the ETF with the largest percentage of its holding in AMZN. A whopping 15.07% of the ETF is in AMZN. It’s the largest holding in the ETF. It has an expense ratio of 0.35%.

First Trust Dow Jones Internet $FDN has the 2nd biggest percentage of its holding in AMZN. FDN has 11.10% of its holding devoted to AMZN. It’s the largest holding in the ETF. It has an expense ratio of 0.57%.

Consumer Discretionary Select SPDR $XLY is next on the list with 10.48% of the ETF in AMZN. It’s the largest holding in the ETF. It has an expense ratio of 0.14%.

Other holdings of ETFs with Amazon stock…

AMZN is the top holding in a retail ETF, an internet ETF, and a consumer discretionary ETF. Any way you slice it, AMZN is a mammoth stock that dominates the holding of market cap weighted ETFs.

RTH tracks an index of the 25 largest US retailers. It’s a great way to get exposure to AMZN and other large US retailers.

FDN tracks an index of the largest and most liquid US internet stocks. It includes 40 stocks that are weighted according to market cap.

XLY tracks an index of consumer discretionary stocks in the S&P 500. It’s a broader ETF than RTH and FDN. You’ll find many of the stocks from both RTH and FDN in XLY’s 89 holdings.

Other ETFs with Amazon stock…

You can find even more ETFs with exposure to Amazon stock using an ETF screener. There are more than 74 ETFs to choose from.

Good Investing,

Corey Williams

Note: Corey Williams writes and edits ETFTradingResearch.com. Sign up for our free ETF reports and free e-letter at http://www.etftradingresearch.com/free-sign-up. We’re devoted to helping you make more money from ETFs.

Category: What's Going On?