ETFs With Kraft Foods $KRFT Exposure

Mergers and acquisitions are sparking the biggest moves among stocks in the S&P 500 this year.

Mergers and acquisitions are sparking the biggest moves among stocks in the S&P 500 this year.

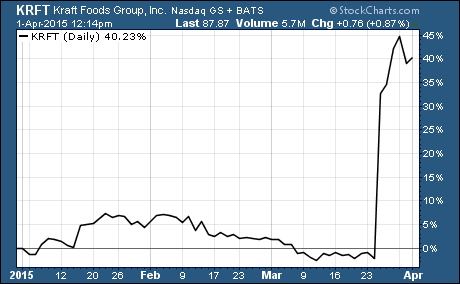

One of those stocks, Kraft Foods Group $KRFT, is up 40% year-to-date.

In case you missed it, KRFT and HJ Heinz are merging. They instantly become the 3rd largest food and beverage company in North America and the 5th largest food and beverage company in the world.

ETFs with exposure to Kraft Foods are a good way to add KRFT and other similar stocks to your portfolio.

Here are Two Unique ETFs with Exposure to Kraft Foods…

KRFT is the largest holding in the Guggenheim Spin-Off ETF $CSD and the ALPS Sector Dividend Dogs ETF $SDOG.

KRFT is 6.16% of the weighting of CSD. This ETF tracks an index of companies that have been spun-off within the past 30 months.

It doesn’t have limitations on market capitalization. It generally holds small- and mid-cap companies with capitalizations under $10 billion.

KRFT is also the largest holding in SDOG with 2.76% of the holdings invested in this stock. SDOG holds the five highest yielding stocks in each US sector. Not surprisingly, this ETF has a solid dividend yield of 3.88%.

Expense Ratios of ETFs with Kraft Foods…

Unique ETFs like these often come at a higher cost. In other words, ETF providers often charge a premium for unique ETFs.

CSD has an expense ratio of 0.66%. This is above average for ETFs. But the unique nature of the ETF requires more oversight than most ETFs.

SDOG’s expense ratio is a much more manageable 0.40%. It’s not surprising to see a lower expense ratio given that its selling point is dividends. And dividend investors are generally more sensitive to expenses.

ETFs with Kraft Food Holdings…

It shouldn’t come as a surprise that the other holdings in CSD and SDOG are very different. One ETF focuses on spin-offs while the other focuses on dividend stocks.

CSD hold KRFT and 40 other stocks. These are stocks that have done a spin-off distribution of stock of a subsidiary company by a parent company. Or a company that has done an equity “carve-out” or “partial initial public offering” in which a parent company sells a percentage of the equity of a subsidiary to public shareholders.

SDOG tracks an index of KRFT and 49 other US dividend stocks. Five stocks from each of the 10 US sectors are selected for inclusion every year on the last trading day of November.

The stocks are rebalanced quarterly so that each sector is 10% and each stock has a 2% weight.

One thing’s for sure, these two ETFs give investors unique ways to add KRFT and other stocks that have something in common with it… In the case of CSD, it’s other companies that have done a spin-off and for SDOG, it’s other high yield stocks.

Good Investing,

Corey Williams

Note: Corey Williams writes and edits ETFTradingResearch.com. Sign up for our free ETF reports and free e-letter at http://etftradingresearch.com/free-sign-up. We’re devoted to helping you make more money from ETFs.

Category: Sector ETFs