Leveraged Semiconductor ETF Battleground

![]() The battle between the bears and bulls over semiconductor stocks is heating up. Aggressive traders can use a leveraged Semiconductor ETF to pick a side and profit.

The battle between the bears and bulls over semiconductor stocks is heating up. Aggressive traders can use a leveraged Semiconductor ETF to pick a side and profit.

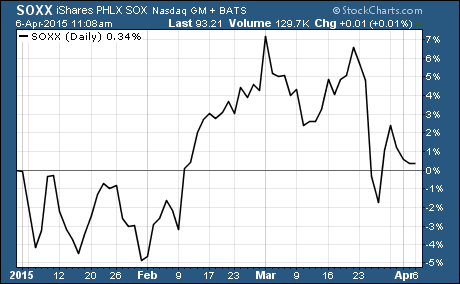

The iShares PHLX SOX Semiconductor Sector Index Fund $SOXX has had some wild swings this year. It was down 5% in January…. It surged to a 7% gain for the year by early March… and today it’s basically back to breakeven for the year.

Now the bulls and bears are making their case for what the future will bring to semiconductor ETFs.

Here’s what the bulls are saying about leveraged semiconductor ETFs…

There’s nothing that helps drive economic growth like technological advancements.

The ongoing evolution of technological progress increases productivity and creates opportunities for growth that are not seen in other areas of the economy. And in today’s economy, technology is more important than ever.

The thing that makes it possible is the microchip.

Right now, the semiconductor industry is capitalizing on the widespread growth of mobile computing and the proliferation of wireless internet connections in even remote regions of the world.

And this trend is still far from over…

Smartphone sales are expected to grow at 7% in 2015. And sales for new cutting edge technology like wearables, 3-D printers, and Ultra HD television displays are expected to balloon more than 250% this year.

Needless to say, semiconductor makers have huge opportunities to grow their business as these technologies become more mainstream.

Here’s what the bears are saying about leveraged semiconductor ETFs…

There’s no denying the positive underlying fundamentals for semiconductor stocks. But fundamentals are only part of the story for short term traders.

You also have to consider things like technical indicators, market momentum, and investor sentiment. These things often have a bigger impact on the short term performance of the stock than the fundamentals.

And right now these short term indicators are aligned against semiconductors.

Right now the semiconductor index is at a dual layer of resistance. In other words, the price action is bearish.

Momentum has swung in favor of the bears. Industry leaders like Micron $MU and Intel $INTC are down for the year.

And sentiment among large investors has begun to sour on semiconductor stocks after their poor performance in the 1st quarter.

These three indicators of short term price performance are clearly pointing toward more pain for semiconductor stocks.

If you think the bulls are right, take a look at buying the ProShares Ultra Semiconductors $USD. This ETF seeks daily investment results that are twice (200%) the daily performance of the Dow Jones US Semiconductors Index.

If you think the bears are right, take a look at buying the ProShares UltraShort Semiconductors $SSG. This ETF seeks daily investment results that are twice (200%) the inverse (opposite) of the daily performance of the Dow Jones US Semiconductor Index.

Good Investing,

Corey Williams

Note: Corey Williams writes and edits ETFTradingResearch.com. Sign up for our free ETF reports and free e-letter at http://etftradingresearch.com/free-sign-up. We’re devoted to helping you make more money from ETFs.

Category: Leveraged ETFs