Get 50 Great Growth Stocks In 1 ETF

Earnings season is in full swing. Once again, companies are pouring billions of dollars into stock buybacks to boost earnings per share or EPS.

Earnings season is in full swing. Once again, companies are pouring billions of dollars into stock buybacks to boost earnings per share or EPS.

Here’s how it works…

Companies repurchase shares of their own stock in the open market. This reduces the number of shares outstanding. The result is a boost to EPS because the earnings are spread over fewer shares.

Shockingly, companies in the S&P 500 spent more on buybacks and dividends than they reported in earnings in Q1. Needless to say, this can’t continue forever. But they will be able to keep it going longer than most believe because they’re funding these buybacks with cheap debt and their massive stockpiles of cash.

But that doesn’t make these companies good investments.

Not surprisingly, some of the biggest spenders on buybacks are massive companies like IBM $IBM, Microsoft $MSFT, and Exxon Mobil $XOM. They have deep pockets and their size and proven track record gives them access to cheap debt.

Here’s the thing…

Stock buybacks give shareholders and management short term gratification. They simply spend cash on buying back shares and… poof, EPS are magically higher.

But they do so at the expense of investing in the business, research and development, and capital expenditures. In other words, they’re sacrificing their long-term growth from innovation to support their stock price in the short term.

Thankfully, more and more investors are coming to terms with the buyback epidemic. They’re starting to realize that this financial engineering won’t support the share price over the long run.

Over the last year, we’re seeing the stocks of companies that are investing in R&D and other growth opportunities outperform the stocks of companies that are choosing to invest heavily in stock buybacks.

In short, anyone that wants to position their portfolio for long term growth needs to shift their focus toward companies that are prioritizing growth.

A New ETF For Growth Stocks

There are plenty of ETFs out there that are focused on growth stocks.

ETFs like iShares Russell 1000 Growth ETF $IWF and Vanguard Growth ETF $VUG are two of the most popular. You’ll find plenty more with an ETF Screener.

But I’m really intrigued by this new growth ETF… the Innovator IBD 50 Fund $FFTY.

This ETF is based on the Investor’s Business Daily (IBD) top 50 growth stocks.

How Stocks Are Selected For The New ETF For Growth Stocks

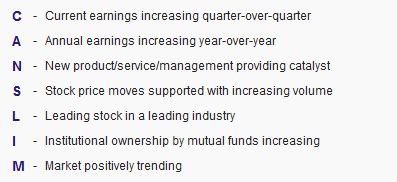

IBD has been using the CAN SLIM formula of fundamental and technical indicators to select the best growth stocks since the company was founded in 1984.

The stocks that are identified are then weighted according to conviction. In other words, stocks with a higher score in the CAN SLIM rankings get a bigger weight in the ETF.

Stocks In The New ETF For Growth Stocks

FFTY is an actively managed ETF. It’s rebalanced on a weekly basis. It’s designed to exit stocks that fall out of the top 50 and buy those that move into the top 50. And it will always rebalance and hold the 50 best growth stocks based on IBD’s CAN SLIM formula.

Right now, stocks like Ambarella $AMBA, Cambrex $CBM, and Criteo $CRTO are top holdings in FFTY. They have weights of 3.68%, 3.58%, and 3.58% respectively. These aren’t the names of stocks you’ll see at the top of other growth ETFs… or any ETF for that matter.

Take a look at adding FFTY to your portfolio. Its unique holdings and focus on growth stocks could make it one of the top performing growth ETFs going forward.

Good Investing,

Corey Williams

Note: Corey Williams writes and edits ETFTradingResearch.com. Sign up for our free ETF reports and free e-letter at http://www.etftradingresearch.com/free-sign-up. We’re devoted to helping you make more money from ETFs.

Category: What's Going On?