Gold Miners ETF In Trouble As Gold Prices Fall

Gold prices are below $1,100 per ounce. That’s a five-year low and right at the price from six years ago.

Gold prices are below $1,100 per ounce. That’s a five-year low and right at the price from six years ago.

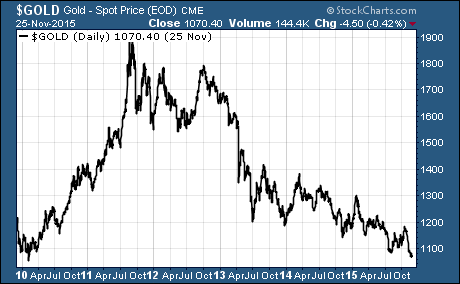

Here’s what a chart of the round trip gold has taken over the last six years.

Gold has lost much of its appeal as an investment. Its status as a store of wealth benefited from the financial crisis back in 2008. And the strong performance in those years brought in many trend followers in the following years.

But those days came to an end in 2011. The recovery from the financial crisis gave people confidence to invest in risk assets, like stocks and bonds, that offer more than a store of wealth.

It continued to decline as the performance sagged and trend followers jumped off the bandwagon. And today, the strengthening US Dollar and a potential interest rate hike continue to put pressure on the price of gold.

Impact Of Falling Gold Prices On The Gold Miners ETF

Gold miner ETFs, like the Market Vectors Gold Miners ETF $GDX, face some serious headwinds from the decline in gold prices.

GDX holds a basket of stocks that are primarily involved in mining for gold. It currently holds 40 stocks and has an expense ratio of 0.53%.

The decline in gold prices has led to a practice called high grading. This is when a company only extracts the gold that’s easiest to get out of the mine.

This technique boosts current production and lowers costs. But it does so at the expense of maximizing the output of the mine over the long run.

According to some reports, this process has rendered more than half of all gold on the books at gold miners unreachable. It isn’t really available to be produced because the cost to mine it is more than the price of gold.

Needless to say, if gold miners were to come out and cut their proven reserves in half, the value of their stocks would plummet… and so will GDX.

The Ugly Future For The Gold Miners ETF

The process of ‘high grading’ a mine will only last so long. The typical life span of a mine is only 5 years when the gold miner only produces the gold that’s easiest to get out of the ground.

So, the end of the line will come sooner rather than later as gold miners will soon start to run out of gold that’s able to be mined at a profit.

Until then, gold miners will continue to flood the market with more gold than ever. They’ll provide more supply than there is demand. And that will continue to drive gold prices down and gold miner profitability down.

The Silver Lining For The Gold Miners ETF

At some point in the next few years, the amount of gold that can be produced at a profit with gold below current prices will diminish quickly. The supply of gold will slow and could lead to higher prices in the future.

These types of situations typically resolve themselves naturally in a free market.

The weaker players are forced out. They go bankrupt or they sell out to a bigger, stronger company. In other words, expect a major consolidation in the industry through mergers and acquisitions.

This should leave a much smaller, but more profitable and stronger, gold mining industry. That’s the time to make an investment in an ETF like GDX. Until then, resist the urge to buy this ETF even though it looks cheap compared to where it was a few years ago.

You can also check out this article on falling gold prices.

And this one on other Gold ETFs for more information on investing in gold.

Good Investing,

Corey Williams

Note: Corey Williams writes and edits ETFTradingResearch.com. Sign up for our free ETF reports and free e-letter at http://www.etftradingresearch.com/free-sign-up. We’re devoted to helping you make more money from ETFs.

Category: Commodity ETFs