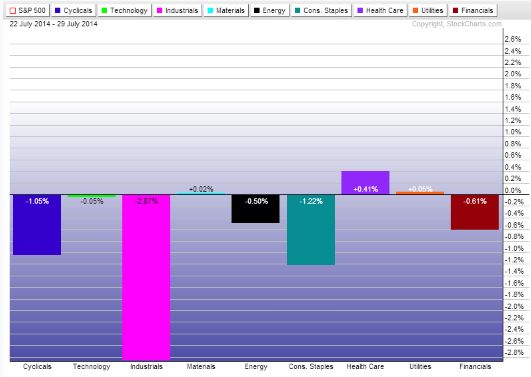

Industrial Sector Breakdown

We’re right in the thick of 2nd quarter earnings season.

We’re right in the thick of 2nd quarter earnings season.

So far, companies in the S&P 500 have done a good job of beating analysts’ revenue and earnings estimates. At the end of last week, 78% of the companies in the S&P 500 that had reported beat earnings per share estimates.

And today’s GDP report showed the US economy grew 4% in the second quarter. And the 1st quarter GDP growth rate was revised to show a smaller contraction.

Furthermore, most economists expect US GDP to continue growing at better than 3% in the 3rd and 4th quarters. That’s an outlook for the US economy that should be bullish for stocks.

However, the S&P 500 has begun to pull back after reaching an all-time high of 1,991 last week. The large cap index is now 1.2% below its high.

With all of the violence and geopolitical upheaval going on around the world, it’s not surprising to see stocks pulling back. The situations in Gaza and Ukraine have clearly deteriorated over the last week.

Nevertheless, it’s a bit surprising to see the S&P 500 pulling back as companies beat earnings estimates and GDP growth is surging. In fact, the worst performing sector over the last week is the economically sensitive industrials sector.

Other economically sensitive sectors like consumer discretionary, energy, and financials haven’t fared much better either.

The recent selloff in industrial stocks has been driven in large part by the bearish breakdown in the chart of Industrials Select Sector SPDR ETF (XLI).

As you can see, the long term uptrend and the short term downtrend collided. When XLI broke through support of the long term uptrend, it triggered a sharp selloff.

What’s more, there were some troubling details in the GDP report that are working against industrials. Growth in inventories contributed 1.66% of the 2nd quarter’s growth.

A spike in inventories can lead to future declines in production if they are unable to sell all of the stuff they’ve already made. So we could see production slow among many of the industrials that had a bigger than expected buildup of inventory.

Here’s the thing…

Right now investors are being flooded with earnings reports, economic data, and geopolitical news. And the result is stocks are pulling back from their recent highs.

These are early warning signs that investors are beginning to lose faith in the bullish outlook for economic growth in the second half of the year.

Good Investing,

Corey Williams

Category: ETFs, Sector ETFs, What's Going On?