Leveraged Financial Sector ETF Battleground

The battle is brewing between the bears and bulls. At the center of their argument are financial stocks. Aggressive traders can use a leveraged financial sector ETF to pick a side and profit.

The battle is brewing between the bears and bulls. At the center of their argument are financial stocks. Aggressive traders can use a leveraged financial sector ETF to pick a side and profit.

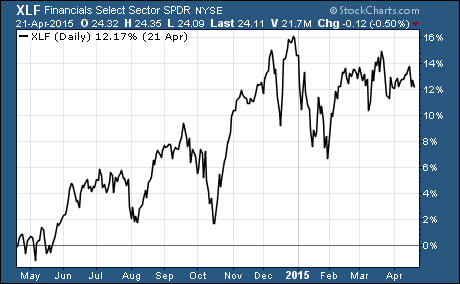

The Financial Select Sector SPDR ETF $XLF is down about 2% so far this year. Financials are also lagging behind the S&P 500 by the same 2% margin over the last year.

Financial stocks have underperformed relative to the large cap index. Now the bulls and bears are making their case for what the future will bring to financial sector ETFs.

Aggressive traders can incorporate leveraged ETFs into their ETF trading system.

Here’s what the bulls are saying about leveraged financial sector ETFs…

The financial sector is poised to have a tremendous 1st quarter. Earnings are expected to jump 14.5% in Q1 from a year ago. And earnings are expected to continue growing at a strong pace through the rest of the year.

In fact, financials have the most optimistic earnings growth outlook of any sector in the S&P 500.

So far, 55% of the financials that have reported 1st quarter earnings have beaten forecasts. Two of the best performances came from the likes of Goldman Sachs $GS and Morgan Stanley $MS that blew away earnings estimates by wide margins.

It appears that financials are finally figuring out how to make money and grow their profits under the new regulations that have been introduced after the 2008 financial crisis.

What’s more, financials stand to benefit from when interest rates go up. The Fed is expected to raise interest rates sometime this year.

Many traders are already trying to get out in front of the Fed. This should lead to a large influx of money into financial stocks as we move closer to the first Fed rate hike.

This is the type of environment that should send investor sentiment toward financial stocks soaring and push the entire sector higher in the weeks ahead.

Here’s what the bears are saying about leveraged financial sector ETFs…

There’s no denying the latest earnings from financial stocks are impressive. But investors aren’t buying into their future growth prospects.

First off, financials had easy comparisons due to some ugly earnings in the first quarter of 2014. So, there’s no reason to think that the impressive growth rates will continue.

In order for financials to reach their current growth estimates, the global economy needs to accelerate. And the most recent economic data shows that the US economy is slowing, not accelerating.

The drop in oil prices has resulted in large savings for consumers at the pump. But instead of spending the money on other items, consumers are saving the money.

Now we’re starting to see the impact of the slowdown in US oil and gas production ripple through the economy. This is leading to slowing job growth that could derail plans for the first Fed interest rate hike since 2006.

If the Fed pushes out their rate hike, we’ll see earning growth estimates for financials tumble through the rest of the year. This will send investors to the exits and push the entire financial sector lower.

In other words, there’s a lot of uncertainty and risk for financials. So much so that even a great 1st quarter earnings season could spark a rally.

If the economy continues to slow, financials will take a big hit in the weeks ahead.

If you think the bulls are right, take a look at buying the Direxion Daily Financial Bull 3x Shares $FAS. FAS seeks daily investment results 300% larger than the performance of the Russell 1000 Financial Services Index.

If you think the bears are right, take a look at buying the Direxion Daily Financial Bear 3x Shares $FAZ. FAZ seeks daily investment results that are 300% of the inverse (or opposite) of the performance of the Russell 1000 Financial Services Index.

Good Investing,

Corey Williams

Note: Corey Williams writes and edits ETFTradingResearch.com. Sign up for our free ETF reports and free e-letter at http://www.etftradingresearch.com/free-sign-up. We’re devoted to helping you make more money from ETFs.

Category: Leveraged ETFs