The Most Popular Income ETF

Income investing hasn’t been easy with the Fed keeping interest rates near 0% since the 2008 financial crisis. That’s a difficult pill to swallow for many retired investors living off their investment income.

Income investing hasn’t been easy with the Fed keeping interest rates near 0% since the 2008 financial crisis. That’s a difficult pill to swallow for many retired investors living off their investment income.

But you can still craft a good income portfolio today. You’ll need to use multiple asset classes like dividend stocks, REITs, MLPs, bonds, preferred stocks, as well as high yield or junk bonds.

But getting exposure to all of these asset classes is no easy task. An investor that just uses stocks to create an income portfolio will spend endless hours sifting through financial data to find good investments.

And the task of monitoring these open positions is even more of a burden. Stock investors have to keep up to date on the financial condition of the individual companies they’re invested in.

Nothing is more detrimental to an income investor than taking a big hit to their capital because one of their stock holdings tanks. So investors can’t ignore the time commitment needed for regular monitoring of individual stocks.

ETFs are hands down a better way for most individual investors to build an income portfolio.

Building An Income Portfolio With ETFs

There are several reasons ETFs are better than stocks for most investors.

First off, you’ll be able to find an ETF tracking just about every asset class you need to build an income portfolio. There are ETFs that just hold dividend stocks, REITs, MLPs, bonds, preferred stocks, as well as ones that only have high yield or junk bonds.

It’s really easy to find these with an ETF screener.

Each of these ETFs provides diversification across a group of holdings for that type of asset. This diversification is great for individual investors.

Diversification eliminates the need to dig into and monitor the financial data of each individual company the way income investors using stocks to build and income portfolio need to.

ETFs spread risk across the entire group of stocks… so, there’s no way for one bad stock to wipe out a large chunk of your capital the way it can if you’re using stocks to build an income portfolio.

And don’t forget, you’ll be saving yourself a lot of money on brokerage fees.

If you bought three stocks in each of the asset classes in your income portfolio, you’ll have to pay a commission on each one of them. With an ETF portfolio, you’ll only need to buy one ETF from each asset class.

And don’t forget, some brokers even have ETFs that you can buy commission free. So you could build an ETF income portfolio without paying any commissions to buy the ETFs.

One Stop Shopping For Income ETF Investors

We’ve talked about the advantages ETFs have over stocks. But there’s still plenty of leg work to be done to build an income portfolio made up of ETFs.

After all, you’ll need to buy 6 or 7 different ETFs if you buy one that specializes in dividend stocks, REITs, MLPs, bonds, preferred stocks, as well as high yield or junk bonds. That means you’ll need to wade through hundreds of ETFs to find the ones you like best.

And if you start breaking dividend stocks down by market-cap and geography, you could have thousands of different ETF options for your income portfolio.

If that sounds like more work than you want to do… you’ll be happy to know there’s an easier way to build an income portfolio… an Income ETF.

That right, there are ETFs specifically designed for multi-asset income investing.

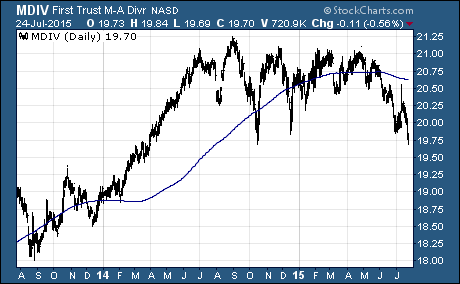

The First Trust Multi-Asset Diversified Income Index Fund $MDIV is the most popular in terms of assets under management… it has more than a billion dollars in it.

Looking Under The Hood Of The Most Popular Income ETF

MDIV tracks the NASDAQ Multi-Asset Diversified Income Index. This index has it all…

- Small, mid and large capitalization income producing stocks

- Domestic and international dividend-paying stocks

- REITs

- Oil and gas or basic materials MLPs

- S.-listed preferred securities

- An ETF that invests in high yield or “junk” bonds.

This ETF holds 127 stocks plus the high yield bond ETF. And you get all of this with a very affordable 0.67% expense ratio.

Over the last year, MDIV has paid out $1.13 in dividends. That’s a dividend yield of 5.62%. That’s an impressive yield that any individual investor would be proud to generate with a stock or ETF income portfolio.

As with any investment, there are pros and cons that you need to consider. But it’s hard for income investors to beat the simplicity, diversification, and income MDIV provides.

Good Investing,

Corey Williams

Note: Corey Williams writes and edits ETFTradingResearch.com. Sign up for our free ETF reports and free e-letter at http://www.etftradingresearch.com/free-sign-up. We’re devoted to helping you make more money from ETFs.

Category: Dividend ETFs